rm(list = ls()) # this line cleans your Global Environment.

setwd("/Users/lucas/Documents/UNU-CDO/courses/ml4p/ml4p-website-v2") # set your working directory

# Libraries

# If this is your first time using R, you need to install the libraries before loading them.

# To do that, you can uncomment the line that starts with install.packages(...) by removing the # symbol.

#install.packages("dplyr", "tidyverse", "caret", "corrplot", "Hmisc", "modelsummary", "plyr", "gt", "stargazer", "elasticnet", "sandwich")

library(dplyr) # core package for dataframe manipulation. Usually installed and loaded with the tidyverse, but sometimes needs to be loaded in conjunction to avoid warnings.

library(tidyverse) # a large collection of packages for data manipulation and visualisation.

library(caret) # a package with key functions that streamline the process for predictive modelling

library(corrplot) # a package to plot correlation matrices

library(Hmisc) # a package for general-purpose data analysis

library(modelsummary) # a package to describe model outputs

library(skimr) # a package to describe dataframes

library(plyr) # a package for data wrangling

library(gt) # a package to edit modelsummary (and other) tables

library(stargazer) # a package to visualise model output

data_malawi <- read_csv("data/malawi.csv") # the file is directly read from the working directory/folder previously setPrediction Policy Problems: Linear Models and Lasso Regression

This section will cover:

- Prediction Policy problems

- Inference vs. prediction for policy analysis

- Assessing accuracy: bias-variance tradeoff

- Training error vs. test error

- Feature selection: brief introduction to Lasso

Introducing the Prediction Policy Framework

In the video-lecture below you’ll be given a brief introduction to the prediction policy framework, and a primer on machine learning. Please take a moment to watch the 20 minute video.

Are you still wondering what the difference is between Machine Learning and Econometrics? Take a few minutes to watch the video below.

After watching the videos, we have a practical exercise.

Practical Example

You can download the dataset by clicking on the button below.

The script below is a step by step on how to go about coding a predictive model using a linear regression. Despite its simplicity and transparency, i.e. the ease with which we can interpret its results, a linear model is not without challenges in machine learning.

1. Preliminaries: working directory, libraries, data upload

import numpy as np # can be used to perform a wide variety of mathematical operations on arrays.

import pandas as pd # mainly used for data analysis and associated manipulation of tabular data in DataFrames

import matplotlib as mpl # comprehensive library for creating static, animated, and interactive visualizations in Python

import sklearn as sk # implement machine learning models and statistical modelling.

import seaborn as sns # for dataframe/vector visualisation

import matplotlib.pyplot as plt # only pyplots from the matplotlib library of visuals

from sklearn.metrics import mean_absolute_error, mean_squared_error # evaluation metrics for ML models. Setting mean_squared_error squared to False will return the RMSE.

import statsmodels.api as sm # to visualise linear models in a nice way...

malawi = pd.read_csv('/Users/lucas/Documents/UNU-CDO/courses/ml4p/ml4p-website-v2/data/malawi.csv') # import csv file and store as malawi2. Get to know your data: visualisation and pre-processing

skim(data_malawi) # describes the dataset in a nice format | Name | data_malawi |

| Number of rows | 11280 |

| Number of columns | 38 |

| _______________________ | |

| Column type frequency: | |

| character | 2 |

| numeric | 36 |

| ________________________ | |

| Group variables | None |

Variable type: character

| skim_variable | n_missing | complete_rate | min | max | empty | n_unique | whitespace |

|---|---|---|---|---|---|---|---|

| region | 0 | 1 | 5 | 6 | 0 | 3 | 0 |

| eatype | 0 | 1 | 5 | 17 | 0 | 5 | 0 |

Variable type: numeric

| skim_variable | n_missing | complete_rate | mean | sd | p0 | p25 | p50 | p75 | p100 | hist |

|---|---|---|---|---|---|---|---|---|---|---|

| lnexp_pc_month | 0 | 1 | 7.360000e+00 | 6.800000e-01 | 4.7800e+00 | 6.890000e+00 | 7.310000e+00 | 7.760000e+00 | 1.106000e+01 | ▁▇▇▁▁ |

| hhsize | 0 | 1 | 4.550000e+00 | 2.340000e+00 | 1.0000e+00 | 3.000000e+00 | 4.000000e+00 | 6.000000e+00 | 2.700000e+01 | ▇▂▁▁▁ |

| hhsize2 | 0 | 1 | 2.613000e+01 | 2.799000e+01 | 1.0000e+00 | 9.000000e+00 | 1.600000e+01 | 3.600000e+01 | 7.290000e+02 | ▇▁▁▁▁ |

| agehead | 0 | 1 | 4.246000e+01 | 1.636000e+01 | 1.0000e+01 | 2.900000e+01 | 3.900000e+01 | 5.400000e+01 | 1.040000e+02 | ▅▇▅▂▁ |

| agehead2 | 0 | 1 | 2.070610e+03 | 1.618600e+03 | 1.0000e+02 | 8.410000e+02 | 1.521000e+03 | 2.916000e+03 | 1.081600e+04 | ▇▃▁▁▁ |

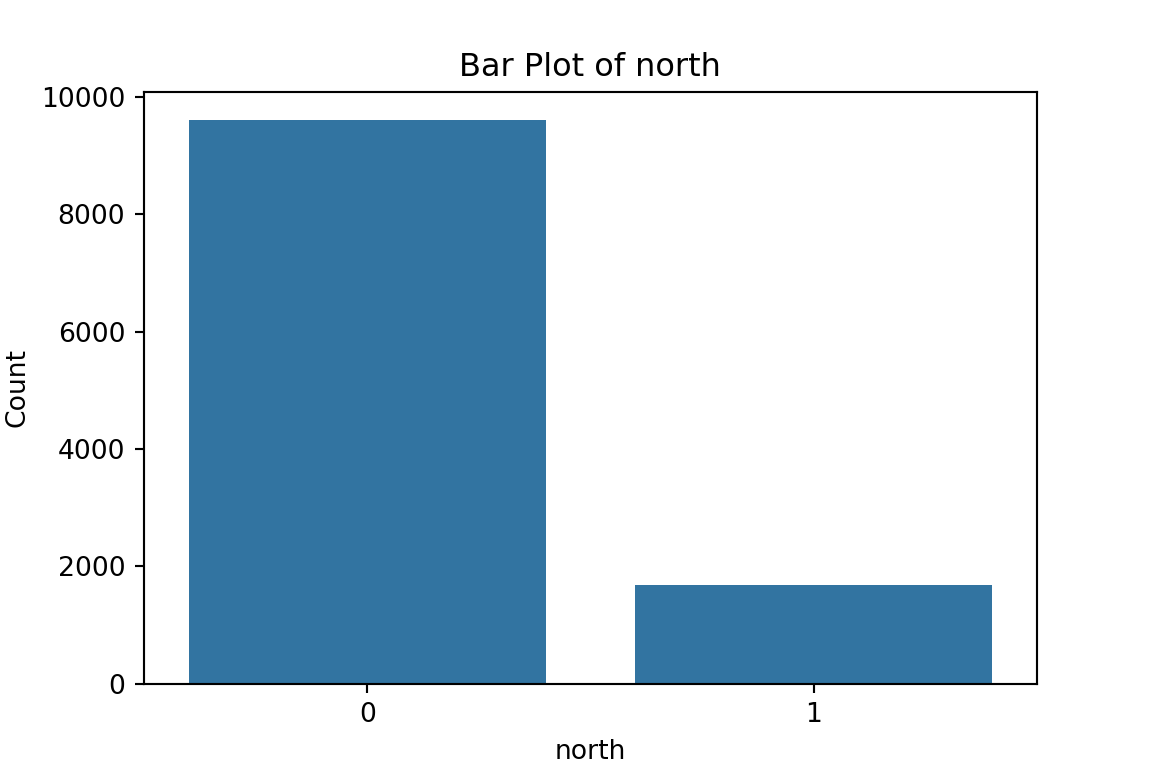

| north | 0 | 1 | 1.500000e-01 | 3.600000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | ▇▁▁▁▂ |

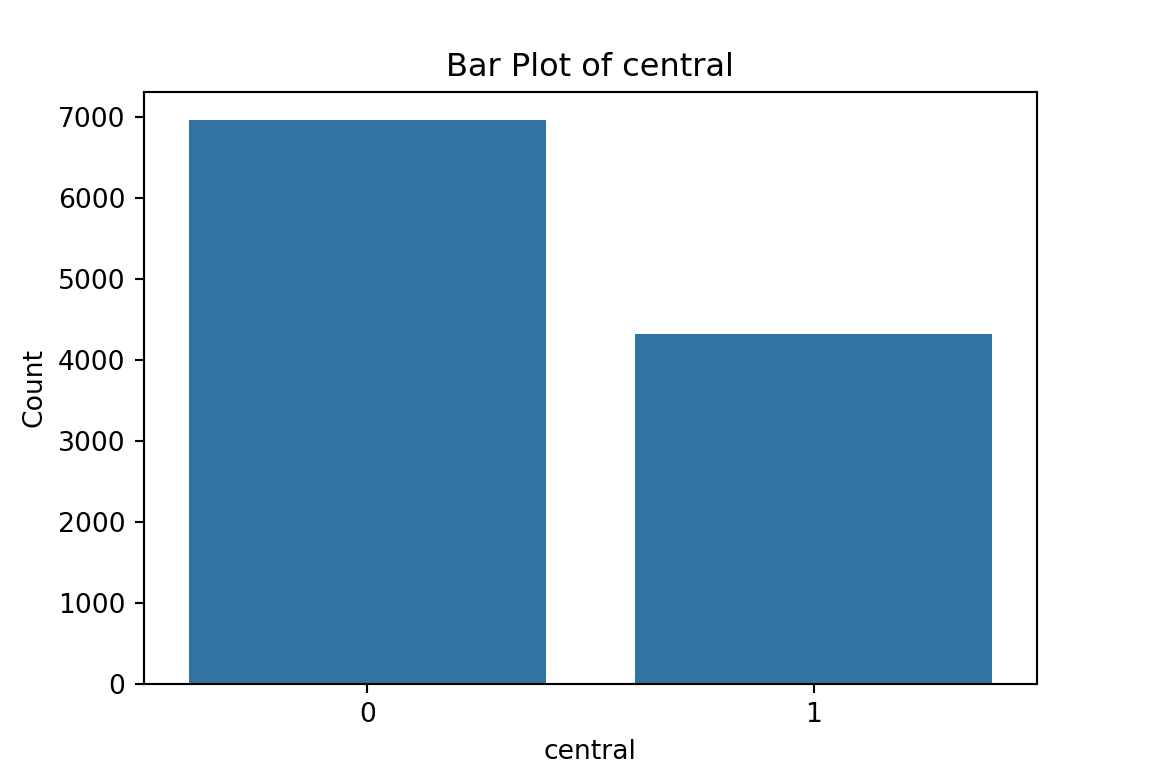

| central | 0 | 1 | 3.800000e-01 | 4.900000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | 1.000000e+00 | ▇▁▁▁▅ |

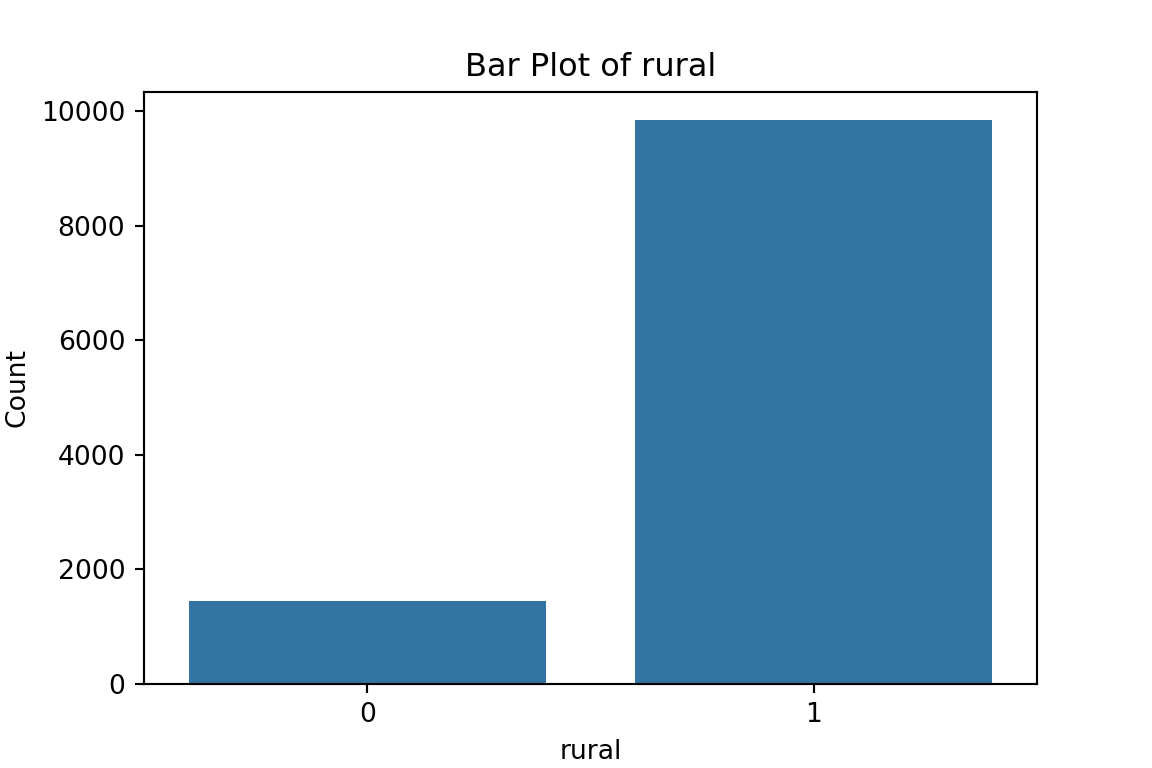

| rural | 0 | 1 | 8.700000e-01 | 3.300000e-01 | 0.0000e+00 | 1.000000e+00 | 1.000000e+00 | 1.000000e+00 | 1.000000e+00 | ▁▁▁▁▇ |

| nevermarried | 0 | 1 | 3.000000e-02 | 1.700000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | ▇▁▁▁▁ |

| sharenoedu | 0 | 1 | 1.700000e-01 | 2.600000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 2.500000e-01 | 1.000000e+00 | ▇▂▁▁▁ |

| shareread | 0 | 1 | 6.100000e-01 | 3.800000e-01 | 0.0000e+00 | 3.300000e-01 | 6.700000e-01 | 1.000000e+00 | 1.000000e+00 | ▅▁▅▂▇ |

| nrooms | 0 | 1 | 2.500000e+00 | 1.300000e+00 | 0.0000e+00 | 2.000000e+00 | 2.000000e+00 | 3.000000e+00 | 1.600000e+01 | ▇▂▁▁▁ |

| floor_cement | 0 | 1 | 2.000000e-01 | 4.000000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | ▇▁▁▁▂ |

| electricity | 0 | 1 | 6.000000e-02 | 2.300000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | ▇▁▁▁▁ |

| flushtoilet | 0 | 1 | 3.000000e-02 | 1.700000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | ▇▁▁▁▁ |

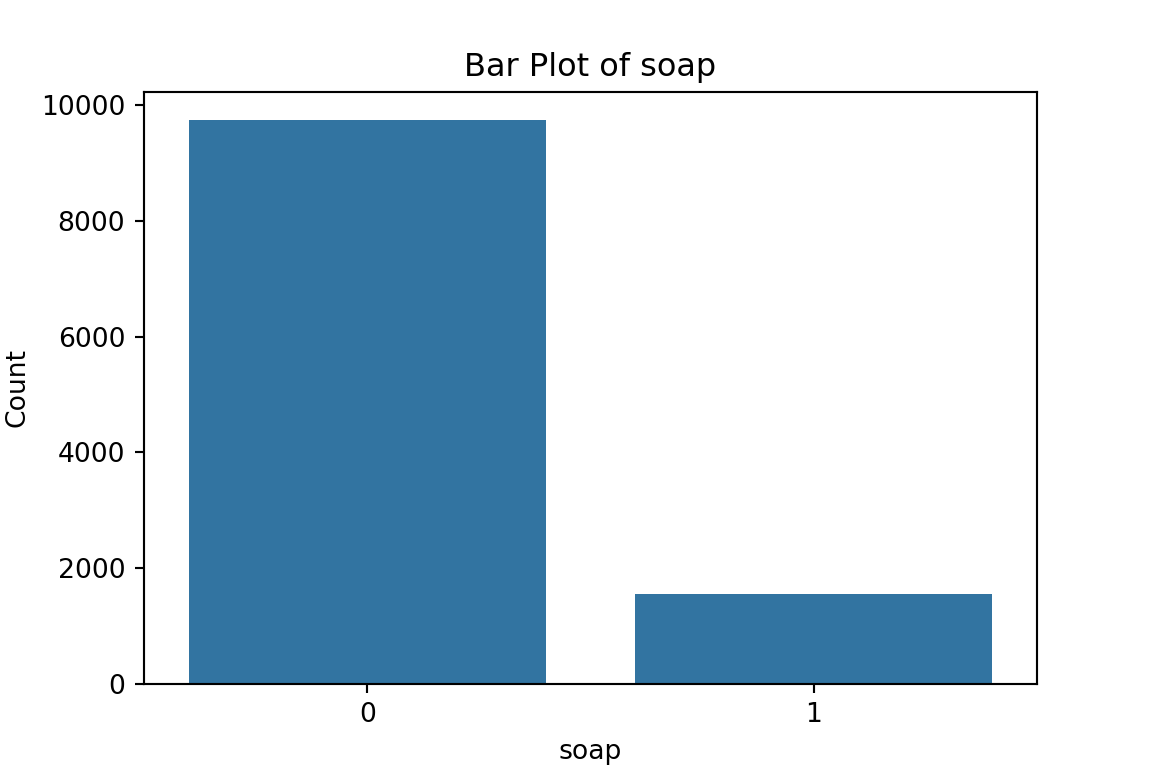

| soap | 0 | 1 | 1.400000e-01 | 3.400000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | ▇▁▁▁▁ |

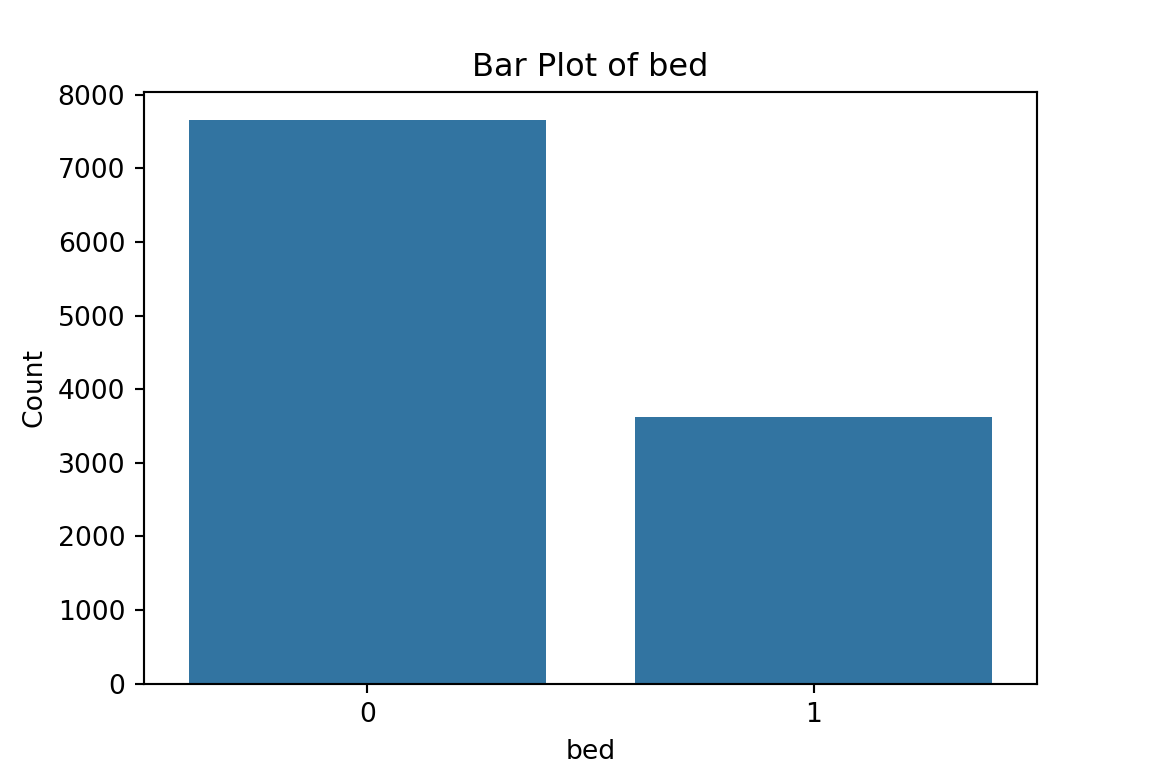

| bed | 0 | 1 | 3.200000e-01 | 4.700000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | 1.000000e+00 | ▇▁▁▁▃ |

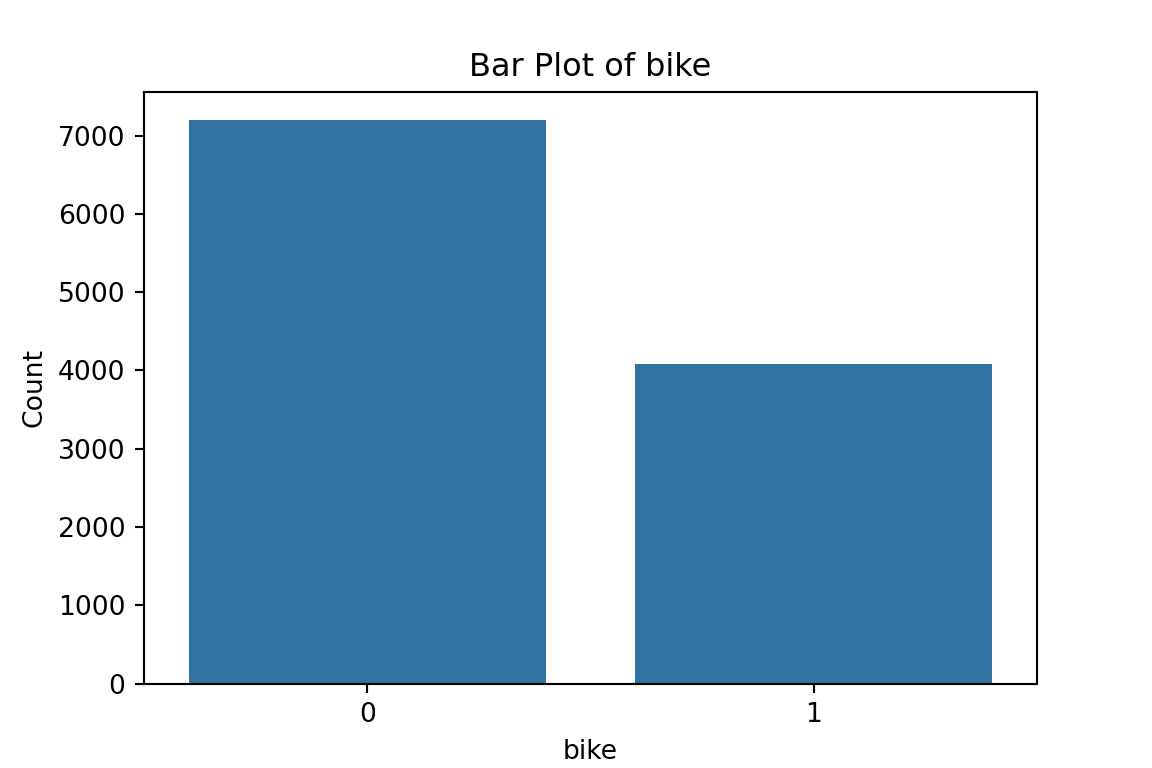

| bike | 0 | 1 | 3.600000e-01 | 4.800000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | 1.000000e+00 | ▇▁▁▁▅ |

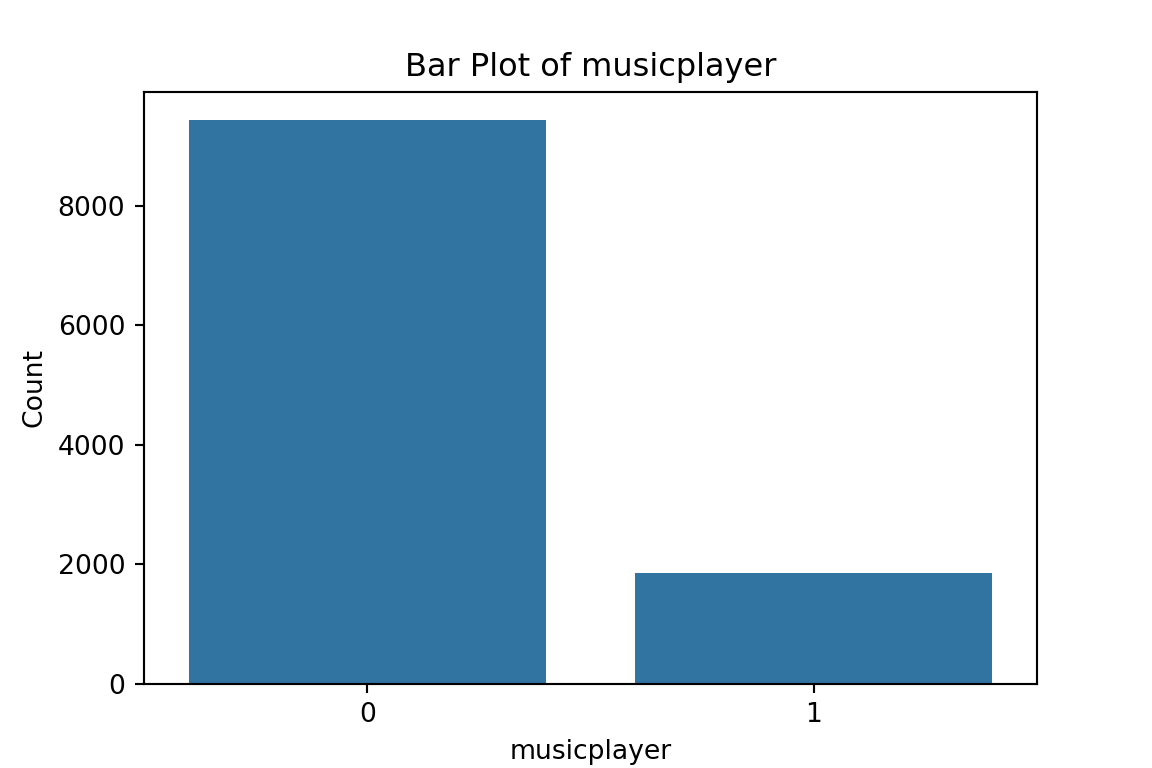

| musicplayer | 0 | 1 | 1.600000e-01 | 3.700000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | ▇▁▁▁▂ |

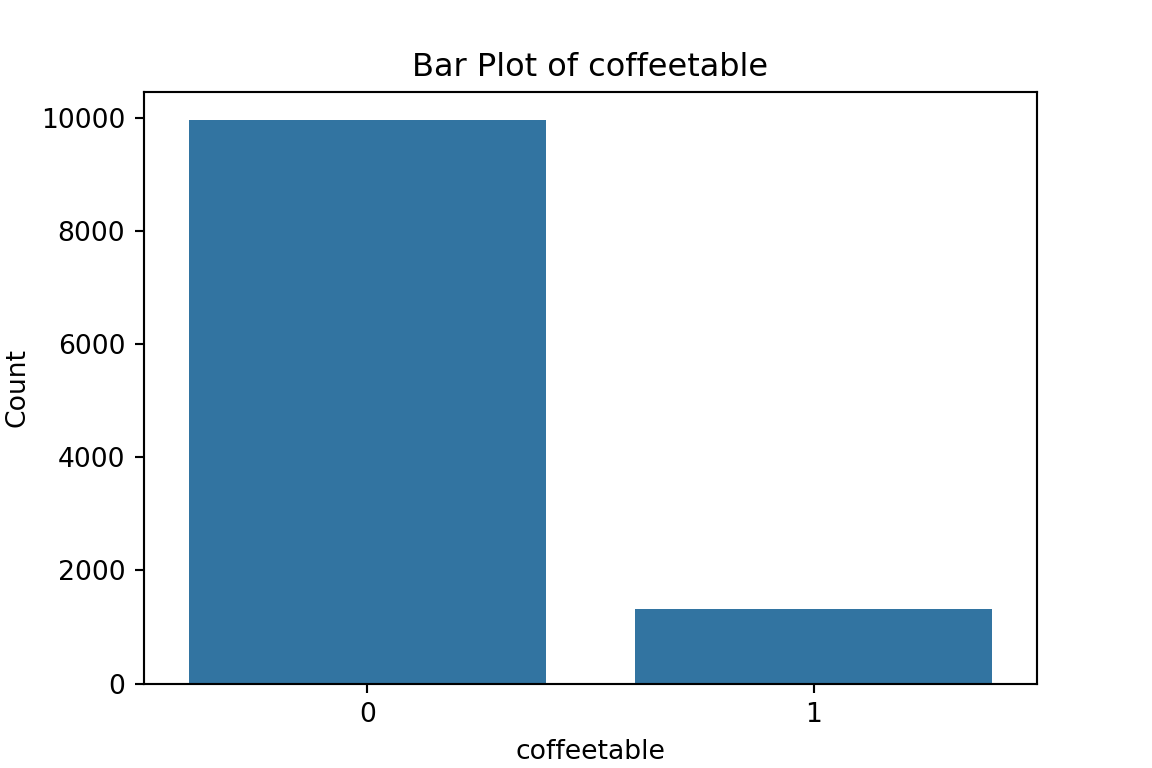

| coffeetable | 0 | 1 | 1.200000e-01 | 3.200000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | ▇▁▁▁▁ |

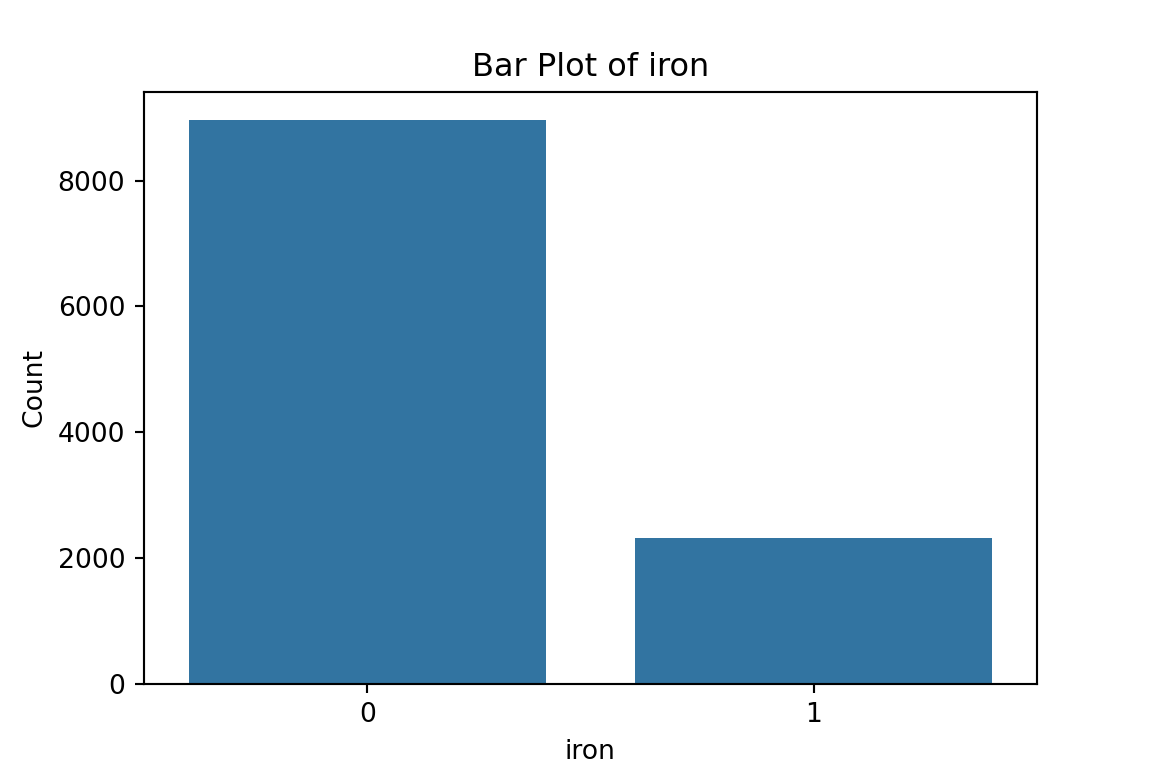

| iron | 0 | 1 | 2.100000e-01 | 4.000000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | ▇▁▁▁▂ |

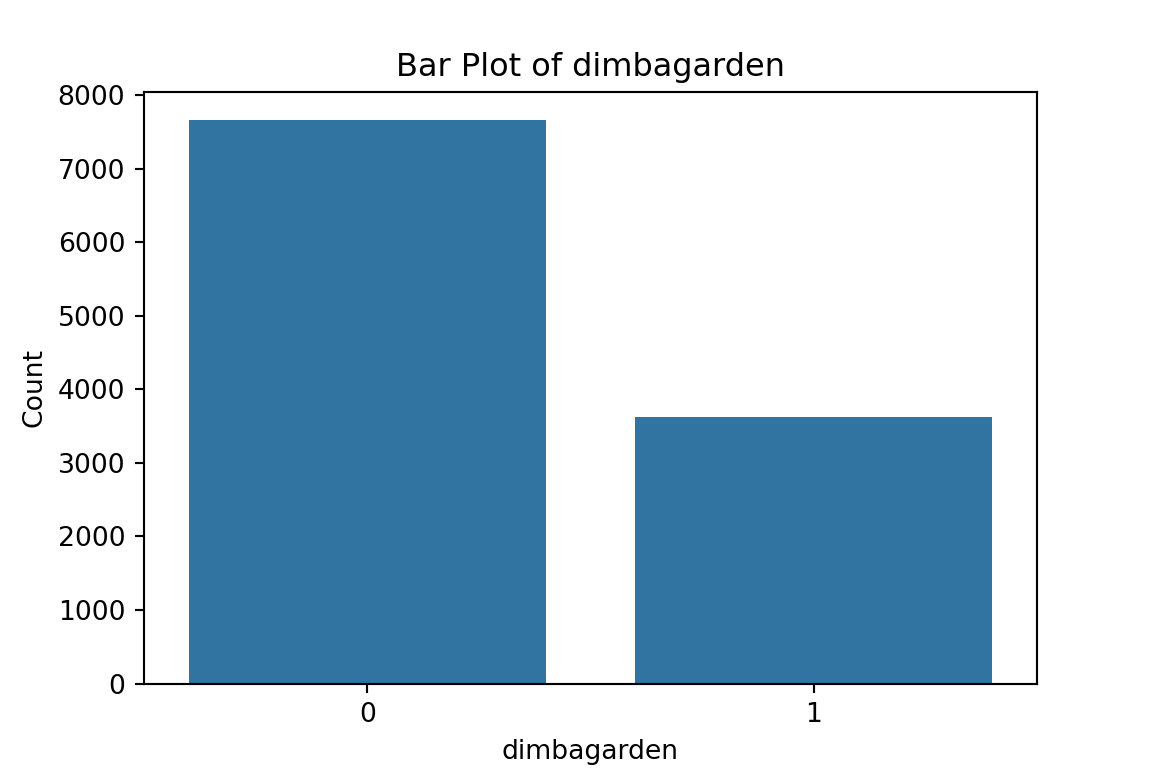

| dimbagarden | 0 | 1 | 3.200000e-01 | 4.700000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | 1.000000e+00 | ▇▁▁▁▃ |

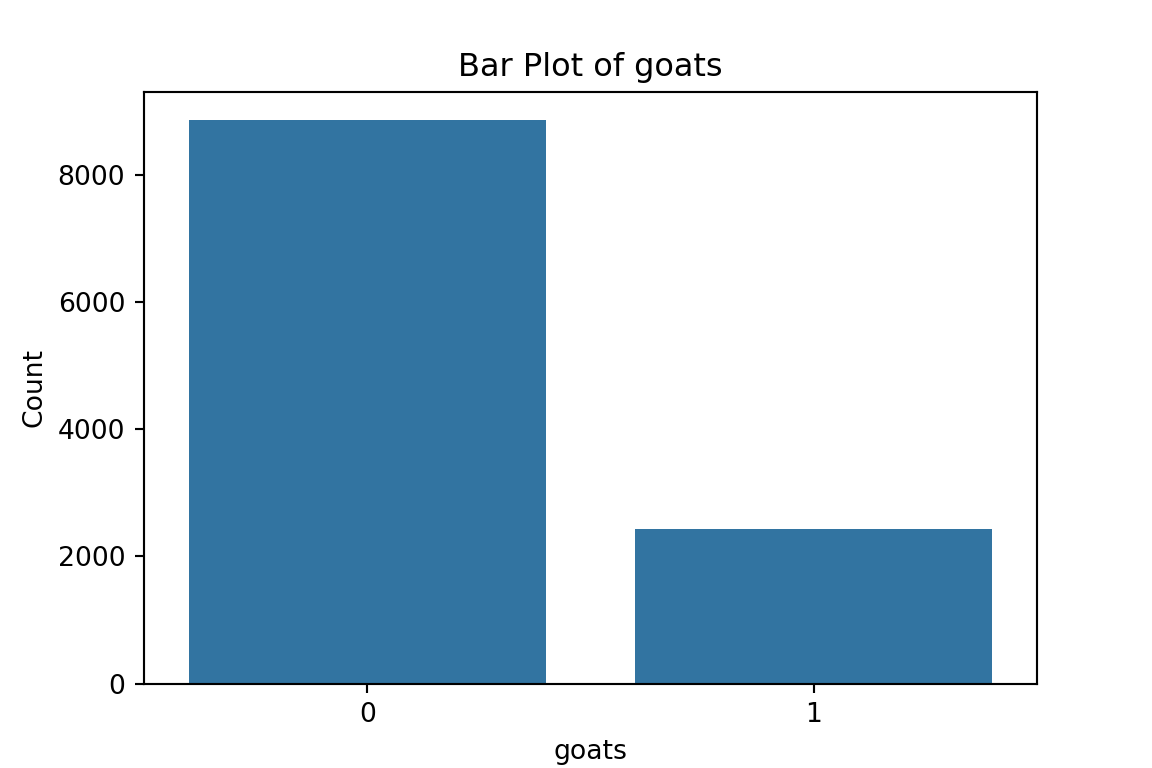

| goats | 0 | 1 | 2.100000e-01 | 4.100000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | ▇▁▁▁▂ |

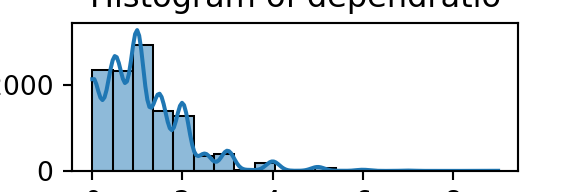

| dependratio | 0 | 1 | 1.120000e+00 | 9.500000e-01 | 0.0000e+00 | 5.000000e-01 | 1.000000e+00 | 1.500000e+00 | 9.000000e+00 | ▇▂▁▁▁ |

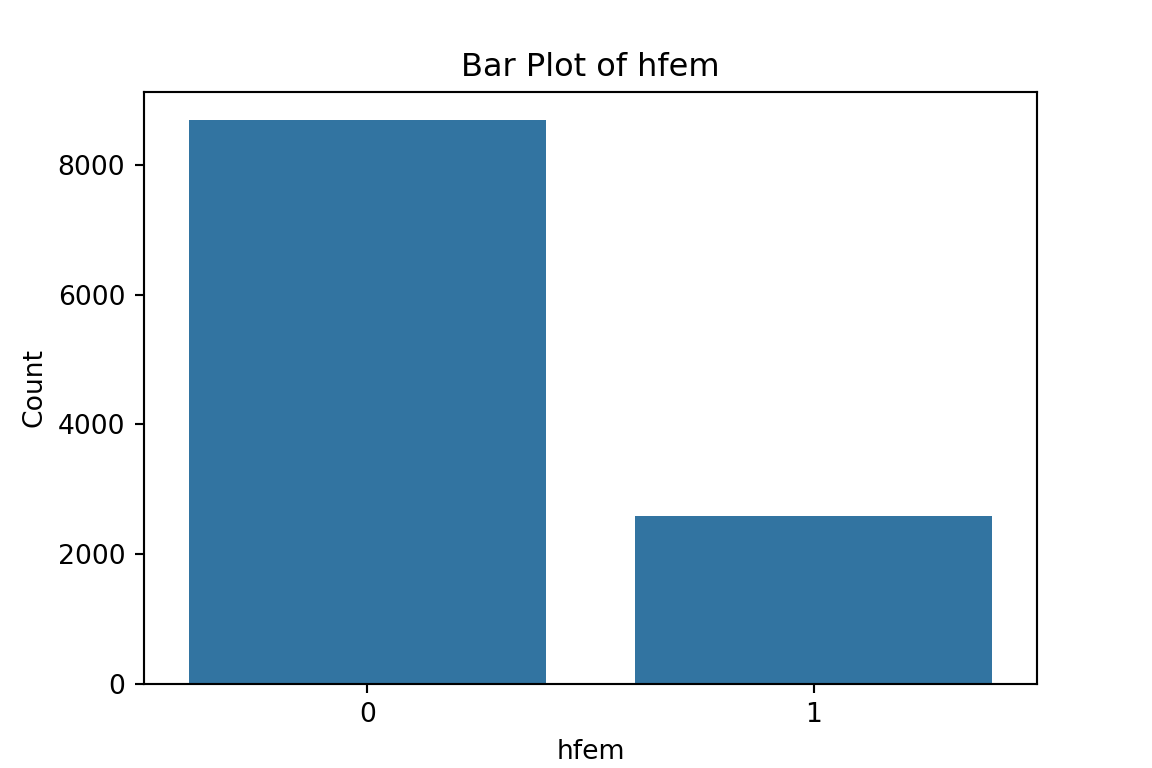

| hfem | 0 | 1 | 2.300000e-01 | 4.200000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | ▇▁▁▁▂ |

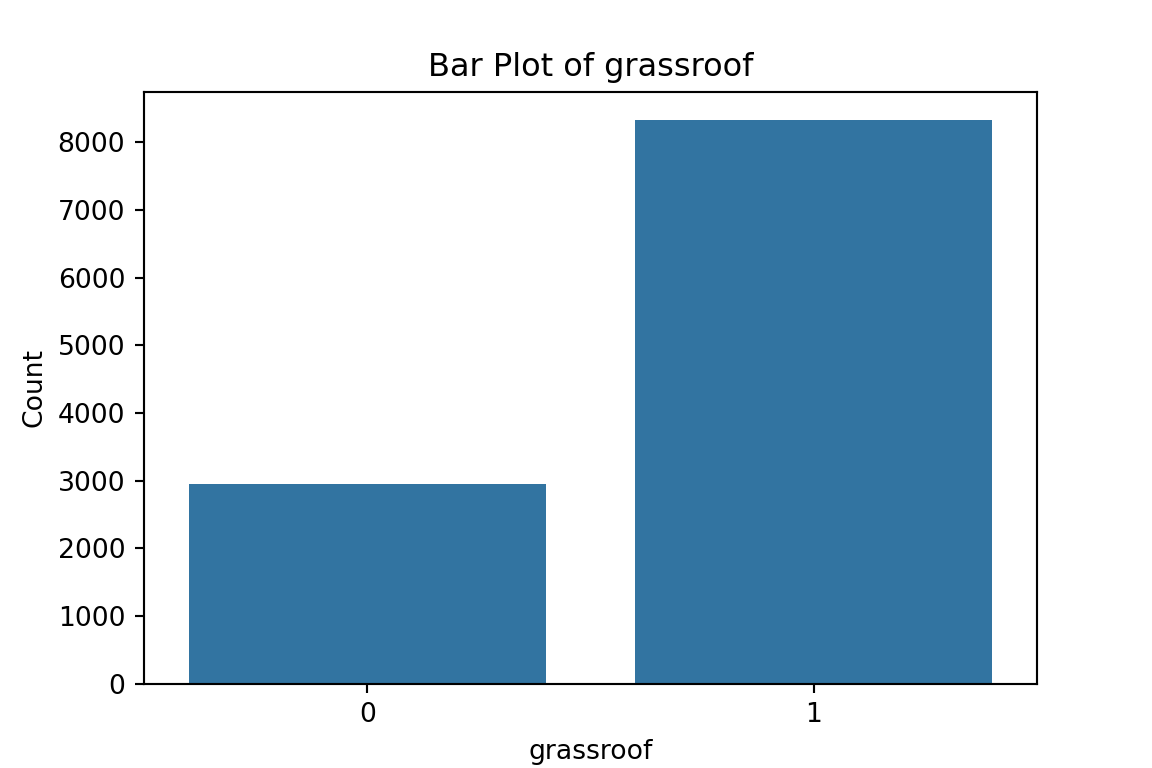

| grassroof | 0 | 1 | 7.400000e-01 | 4.400000e-01 | 0.0000e+00 | 0.000000e+00 | 1.000000e+00 | 1.000000e+00 | 1.000000e+00 | ▃▁▁▁▇ |

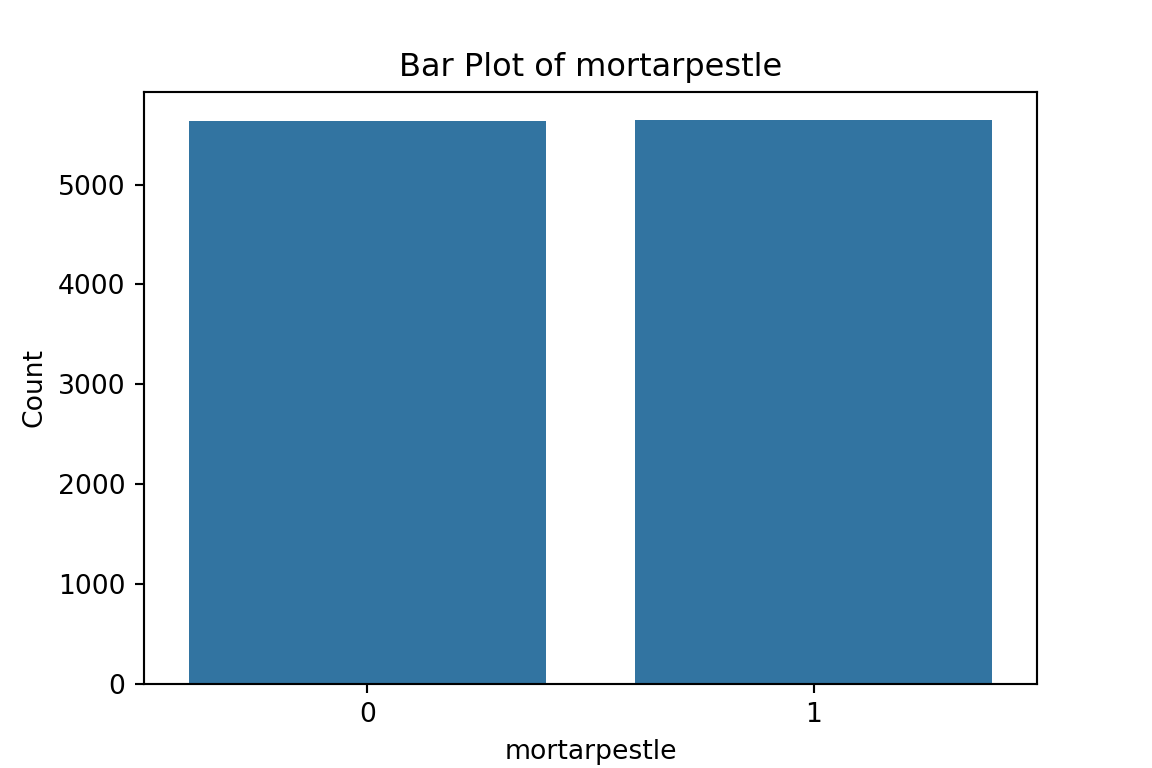

| mortarpestle | 0 | 1 | 5.000000e-01 | 5.000000e-01 | 0.0000e+00 | 0.000000e+00 | 1.000000e+00 | 1.000000e+00 | 1.000000e+00 | ▇▁▁▁▇ |

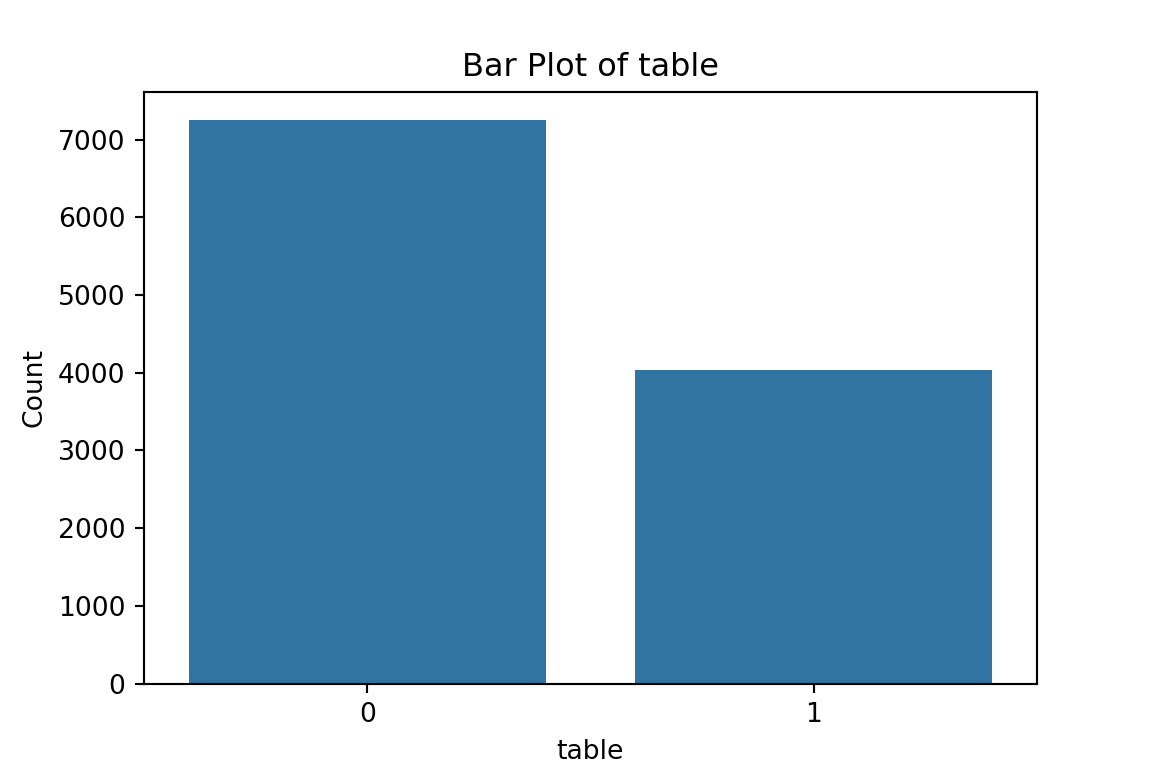

| table | 0 | 1 | 3.600000e-01 | 4.800000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | 1.000000e+00 | ▇▁▁▁▅ |

| clock | 0 | 1 | 2.000000e-01 | 4.000000e-01 | 0.0000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 | ▇▁▁▁▂ |

| ea | 0 | 1 | 7.606000e+01 | 1.885500e+02 | 1.0000e+00 | 8.000000e+00 | 1.900000e+01 | 4.525000e+01 | 9.010000e+02 | ▇▁▁▁▁ |

| EA | 0 | 1 | 2.372322e+07 | 7.241514e+06 | 1.0101e+07 | 2.040204e+07 | 2.090352e+07 | 3.053301e+07 | 3.120209e+07 | ▂▁▆▁▇ |

| hhwght | 0 | 1 | 2.387900e+02 | 7.001000e+01 | 7.9000e+01 | 2.076000e+02 | 2.471000e+02 | 2.913000e+02 | 3.587000e+02 | ▂▁▇▇▂ |

| psu | 0 | 1 | 2.372322e+07 | 7.241514e+06 | 1.0101e+07 | 2.040204e+07 | 2.090352e+07 | 3.053301e+07 | 3.120209e+07 | ▂▁▆▁▇ |

| strataid | 0 | 1 | 1.560000e+01 | 8.090000e+00 | 1.0000e+00 | 9.000000e+00 | 1.500000e+01 | 2.200000e+01 | 3.000000e+01 | ▅▇▇▆▅ |

| lnzline | 0 | 1 | 7.550000e+00 | 0.000000e+00 | 7.5500e+00 | 7.550000e+00 | 7.550000e+00 | 7.550000e+00 | 7.550000e+00 | ▁▁▇▁▁ |

| case_id | 0 | 1 | 2.372322e+10 | 7.241514e+09 | 1.0101e+10 | 2.040204e+10 | 2.090352e+10 | 3.053301e+10 | 3.120209e+10 | ▂▁▆▁▇ |

The dataset contains 38 variables and 11,280 observations.

Not all of these variables are relevant for our prediction model.

To find the labels and description of the variables, you can refer to the paper.

[hhsize, hhsize2, age_head, age_head2, regions, rural, never married, share_of_adults_without_education, share_of_adults_who_can_read, number of rooms, cement floor, electricity, flush toilet, soap, bed, bike, music player, coffee table, iron, garden, goats]

Luckily for us, we have no missing values (n_missing in summary output)!

Many machine learning models cannot be trained when missing values are present (some exceptions exist).

Dealing with missingness is a non-trivial task:

First and foremost, we should assess whether there is a pattern to missingness and if so, what that means to what we can learn from our (sub)population. If there is no discernible pattern, we can proceed to delete the missing values or impute them. A more detailed explanation and course of action can be found here.

Feature selection: subsetting the dataset

As part of our data pre-processing we will subset the dataframe, such that only relevant variables are left. * Relevant: variables/features about a household that could help us determine whether they are in poverty. That way, we save some memory space; but also, we can call the full set of variables in a dataframe in one go!

variables to delete (not included in the identified set above):

[ea, EA, hhwght, psu, strataid, lnzline, case_id, eatype] N/B: Feature selection is a critical process (and we normally don’t have a paper to guide us through it): from a practical point of view, a model with less predictors may be easier to interpret. Also, some models may be negatively affected by non-informative predictors. This process is similar to traditional econometric modelling, but we should not conflate predictive and explanatory modelling. Importantly, please note that we are not interested in knowing why something happens, but rather in what is likely to happen given some known data. Hence:

# object:vector that contains the names of the variables that we want to get rid of

cols <- c("ea", "EA", "psu","hhwght", "strataid", "lnzline", "case_id","eatype")

# subset of the data_malawi object:datframe

data_malawi <- data_malawi[,-which(colnames(data_malawi) %in% cols)] # the minus sign indicates deletion of colsA few notes for you:

a dataframe follows the form data[rows,colums]

colnames() is a function that identifies the column names of an object of class dataframe

which() is an R base function that gives you the position of some value

a minus sign will delete either the identified position in the row or the column space

Data visualisation

A quick and effective way to take a first glance at our data is to plot histograms of relevant (numeric) features.

Recall (from the skim() dataframe summary output) that only two variables are non-numeric. However, we need to make a distinction between class factor and class numeric/numeric.

# identify categorical variables to transform from class numeric to factor

# using a for-loop: print the number of unique values by variable

for (i in 1:ncol(data_malawi)) { # iterate over the length of columns in the data_malawi df

# store the number of unique values in column.i

x <- length(unique(data_malawi[[i]]))

# print the name of column.i

print(colnames(data_malawi[i]))

# print the number of unique values in column.i

print(x)

}[1] "lnexp_pc_month"

[1] 11266

[1] "hhsize"

[1] 19

[1] "hhsize2"

[1] 19

[1] "agehead"

[1] 88

[1] "agehead2"

[1] 88

[1] "north"

[1] 2

[1] "central"

[1] 2

[1] "rural"

[1] 2

[1] "nevermarried"

[1] 2

[1] "sharenoedu"

[1] 47

[1] "shareread"

[1] 28

[1] "nrooms"

[1] 16

[1] "floor_cement"

[1] 2

[1] "electricity"

[1] 2

[1] "flushtoilet"

[1] 2

[1] "soap"

[1] 2

[1] "bed"

[1] 2

[1] "bike"

[1] 2

[1] "musicplayer"

[1] 2

[1] "coffeetable"

[1] 2

[1] "iron"

[1] 2

[1] "dimbagarden"

[1] 2

[1] "goats"

[1] 2

[1] "dependratio"

[1] 62

[1] "hfem"

[1] 2

[1] "grassroof"

[1] 2

[1] "mortarpestle"

[1] 2

[1] "table"

[1] 2

[1] "clock"

[1] 2

[1] "region"

[1] 3If you want to optimise your code, using for loops is not ideal. In R, there exists a family of functions called Apply whose purpose is to apply some function to all the elements in an object. For the time being, iterating over 38 columns is fast enough and we don’t need to think about optimising our code. We’ll also see an example later on on how to use one of the functions from the apply family. You can also refer to this blog (https://www.r-bloggers.com/2021/05/apply-family-in-r-apply-lapply-sapply-mapply-and-tapply/) if you want to learn more about it.

Notice that we have a few variables with 2 unique values and one variable with 3 unique values. We should transform these into factor() class. Recall from the introduction tab that in object-oriented programming correctly identifying the variable type (vector class) is crucial for data manipulation and arithmetic operations. We can do this one by one, or in one shot. I’ll give an example of both:

# == One by one == #

# transform a variable in df to factor, and pass it on to the df to keep the change

# first, sneak peak at the first 5 observations (rows) of the vector

head(data_malawi$north) # returns 1 = North [1] 1 1 1 1 1 1data_malawi$north <- factor(data_malawi$north, levels = c(0, 1), labels = c("NotNorth", "North"))

str(data_malawi$north) # returns 2? Factor w/ 2 levels "NotNorth","North": 2 2 2 2 2 2 2 2 2 2 ...head(data_malawi$north) # returns north (which was = 1 before), hooray![1] North North North North North North

Levels: NotNorth North# R stores factors as 1...n; but the label remains the initial numeric value assigned (1 for true, 0 false)

# We have also explicityly told 0 is NotNorth and 1 is North (by the order that follows the line of code)

# transform all binary/categorical data into factor class

min_count <- 3 # vector: 3 categories is our max number of categories found

# == Apply family: function apply and lapply==#

# apply a length(unique(x)) function to all the columns (rows = 1, columns = 2) of the data_malawi dataframe, then

# store boolean (true/false) if the number of unique values is lower or equal to the min_count vector

n_distinct2 <- apply(data_malawi, 2, function(x) length(unique(x))) <= min_count

# print(n_distinct2) # prints boolean indicator object (so you know what object you have created)

# select the identified categorical variables and transform them into factors

data_malawi[n_distinct2] <- lapply(data_malawi[n_distinct2], factor) Visualise your data: histograms, bar plots, tables

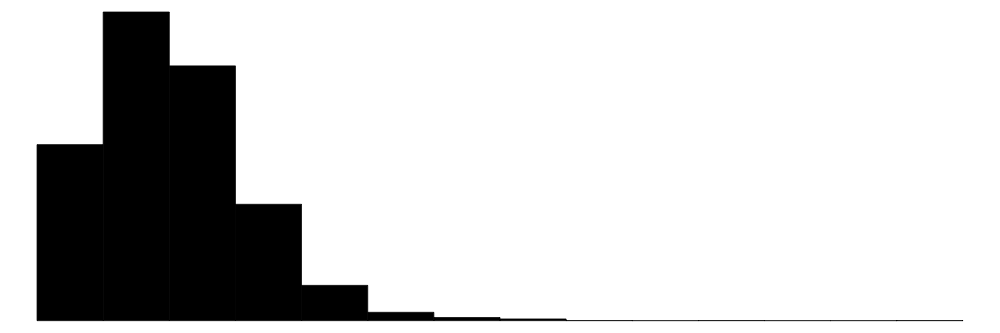

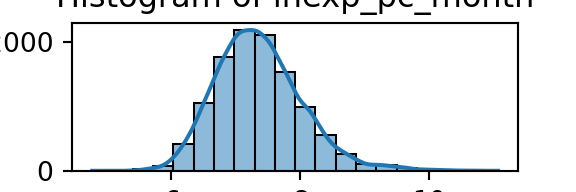

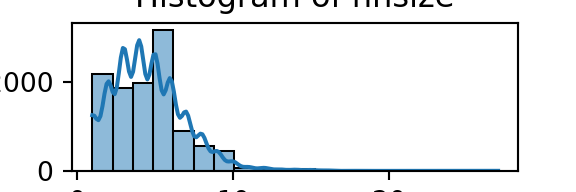

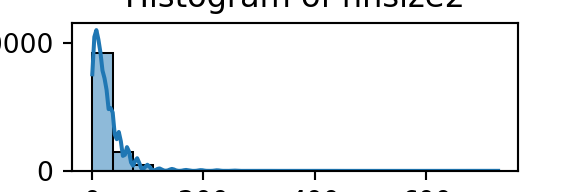

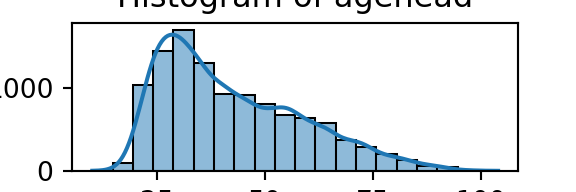

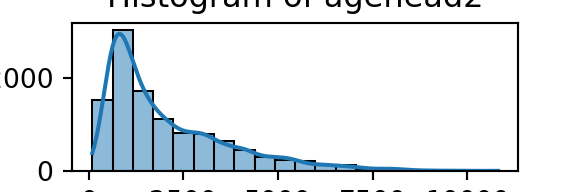

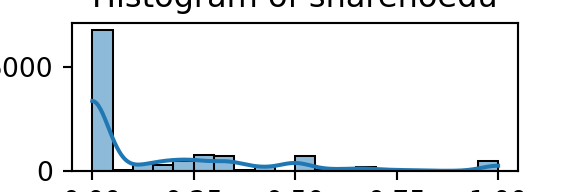

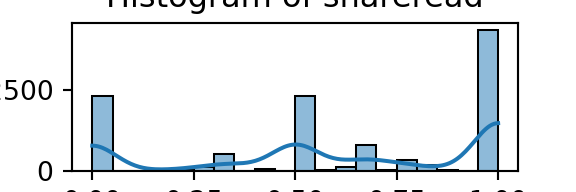

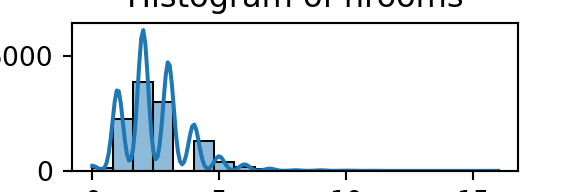

Let’s start with histograms of numeric (continuous) variables.

# == HISTOGRAMS == #

# Select all variables in the dataframe which are numeric, and can therefore be plotted as a histogram.

malawi_continuous <- as.data.frame(data_malawi %>% select_if(~is.numeric(.)))

# a quick glance at the summary statistics of our continuous variables

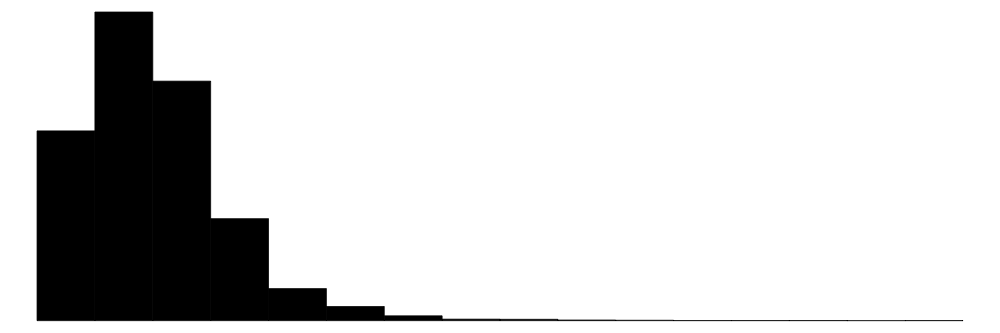

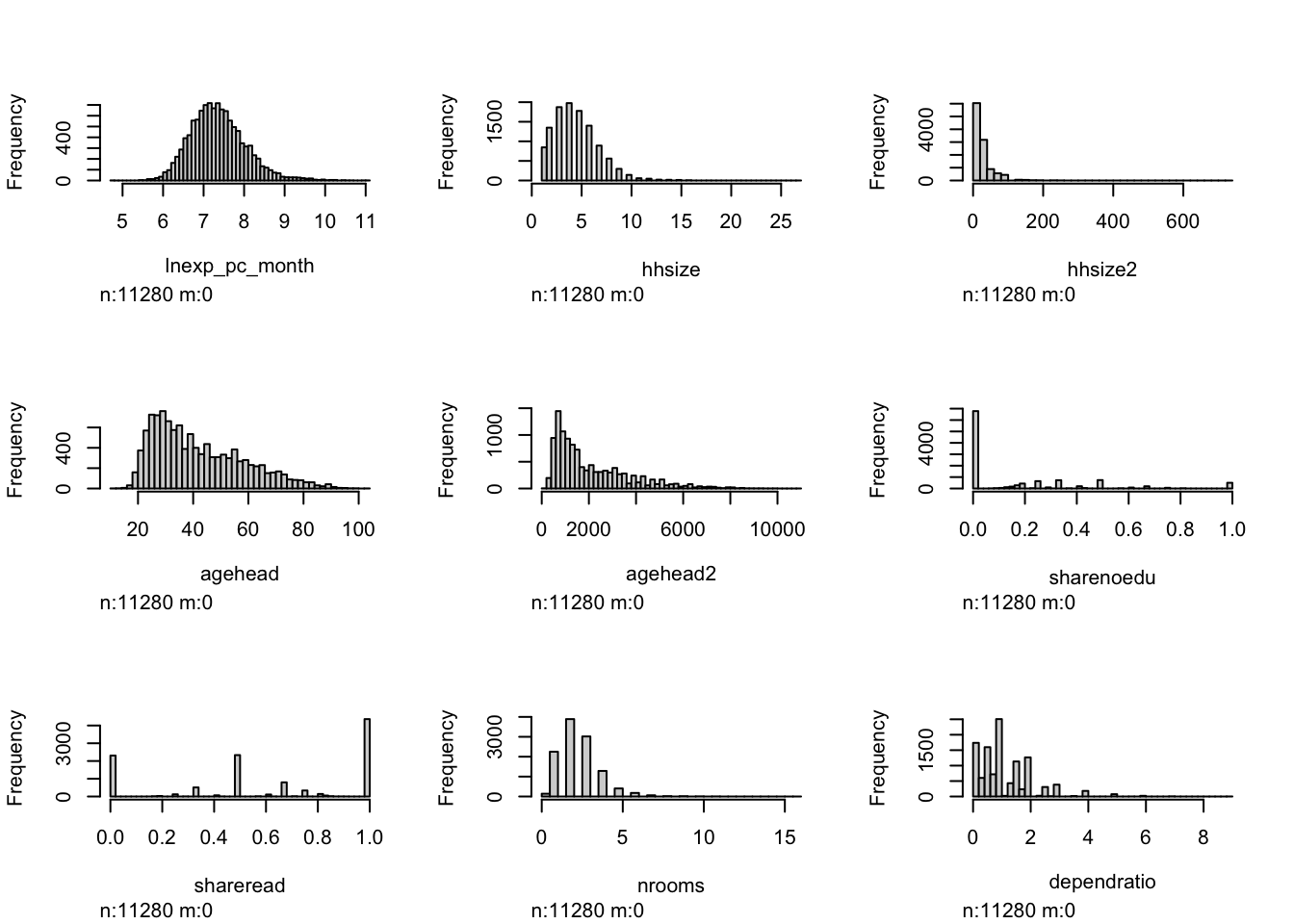

datasummary_skim(malawi_continuous) # from modelsummary pkg, output as plot in Plot Viewer| Unique | Missing Pct. | Mean | SD | Min | Median | Max | Histogram | |

|---|---|---|---|---|---|---|---|---|

| lnexp_pc_month | 11266 | 0 | 7.4 | 0.7 | 4.8 | 7.3 | 11.1 |  |

| hhsize | 19 | 0 | 4.5 | 2.3 | 1.0 | 4.0 | 27.0 |  |

| hhsize2 | 19 | 0 | 26.1 | 28.0 | 1.0 | 16.0 | 729.0 |  |

| agehead | 88 | 0 | 42.5 | 16.4 | 10.0 | 39.0 | 104.0 |  |

| agehead2 | 88 | 0 | 2070.6 | 1618.6 | 100.0 | 1521.0 | 10816.0 |  |

| sharenoedu | 47 | 0 | 0.2 | 0.3 | 0.0 | 0.0 | 1.0 |  |

| shareread | 28 | 0 | 0.6 | 0.4 | 0.0 | 0.7 | 1.0 |  |

| nrooms | 16 | 0 | 2.5 | 1.3 | 0.0 | 2.0 | 16.0 |  |

| dependratio | 62 | 0 | 1.1 | 0.9 | 0.0 | 1.0 | 9.0 |  |

# Hmisc package, quick and painless hist.data.frame() function

# but first, make sure to adjust the number of rows and columns to be displayed on your Plot Viewer

par(mfrow = c(3, 3)) # 3 rows * 3 columns (9 variables)

hist.data.frame(malawi_continuous)

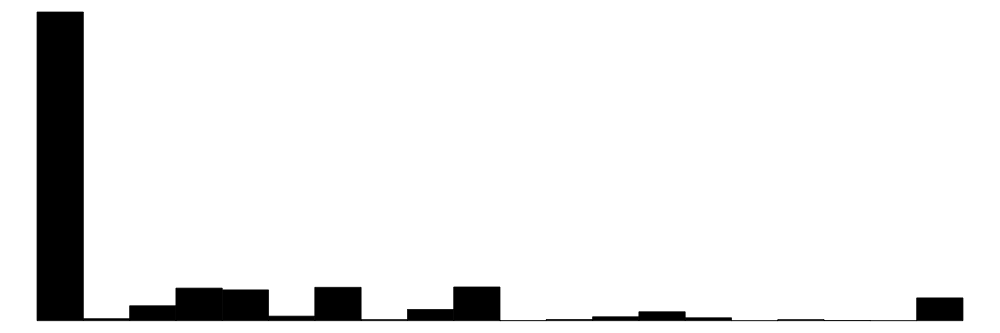

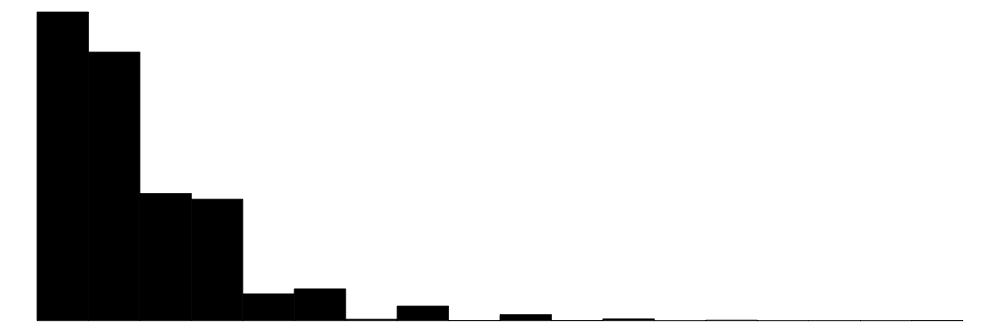

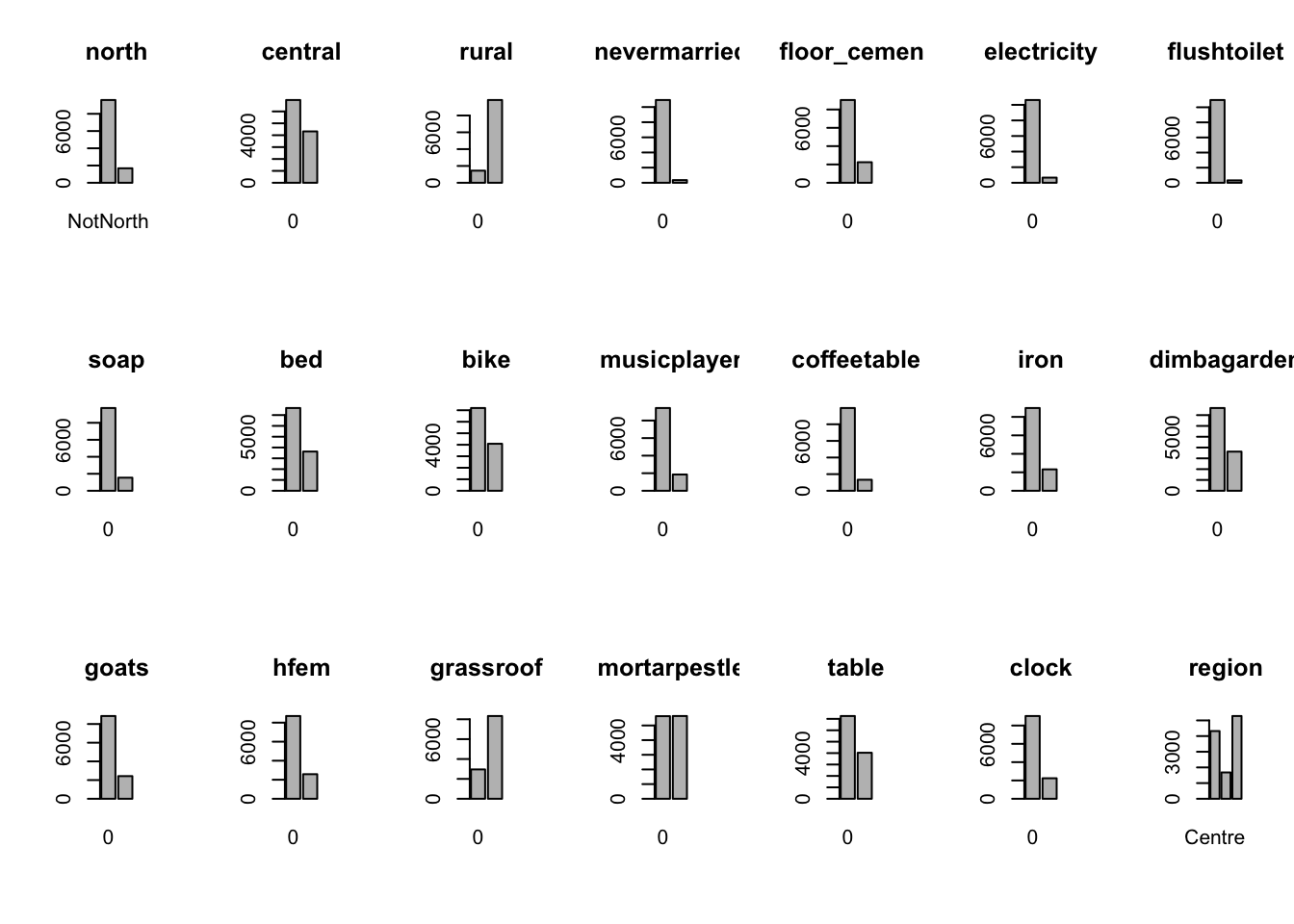

Now, let’s plot bar graphs and write tables of factor (categorical) variables:

# == BAR GRAPHS == #

malawi_factor <- data_malawi %>% select_if(~is.factor(.)) # subset of the data with all factor variables

par(mfrow = c(3, 7)) # 7 rows, 3 columns (21 variables = length of df)

for (i in 1:ncol(malawi_factor)) { # Loop over all the columns in the factor df subset

# store data in column.i as x

x <- malawi_factor[,i]

# store name of column.i as x_name

x_name <- colnames(malawi_factor[i])

# Plot bar graph of x using Rbase plotting tools

barplot(table(x),

main = paste(x_name)

)

}

# == TABLES == #

# We can also show tables of all factor variables (to get precise frequencies not displayed in bar plots)

llply(.data=malawi_factor, .fun=table) # create tables of all the variables in dataframe using the plyr package$north

NotNorth North

9600 1680

$central

0 1

6960 4320

$rural

0 1

1440 9840

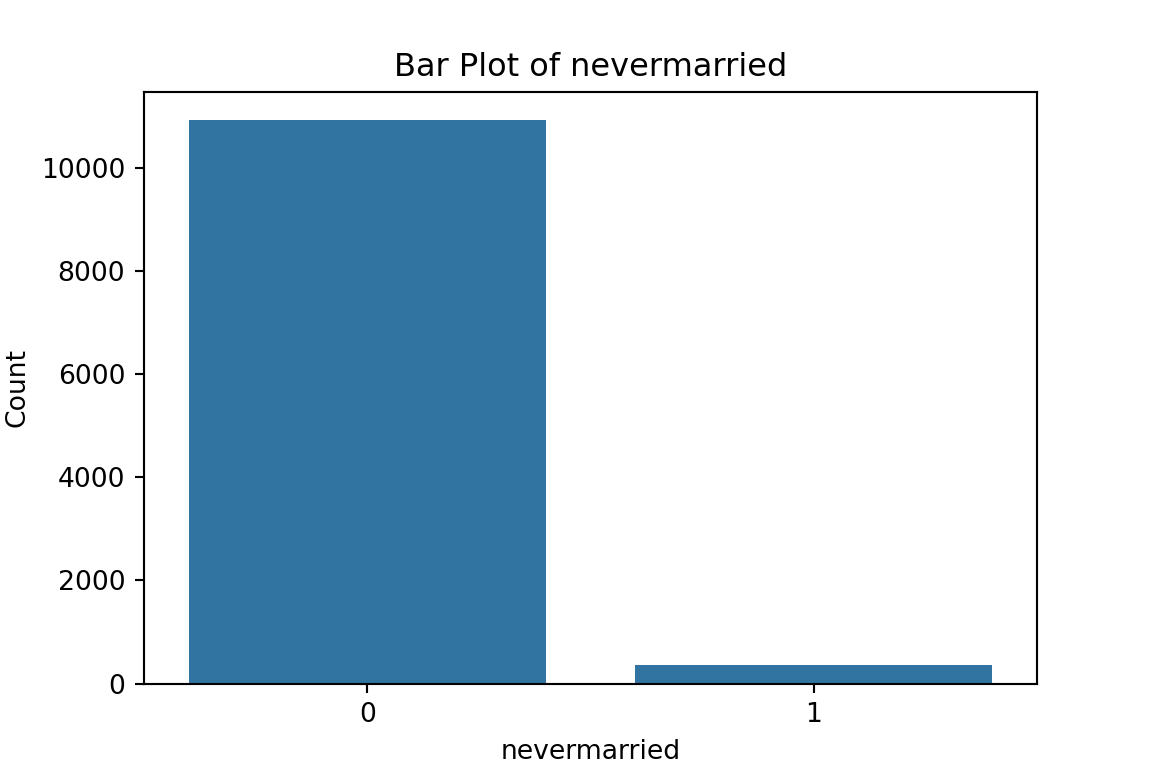

$nevermarried

0 1

10930 350

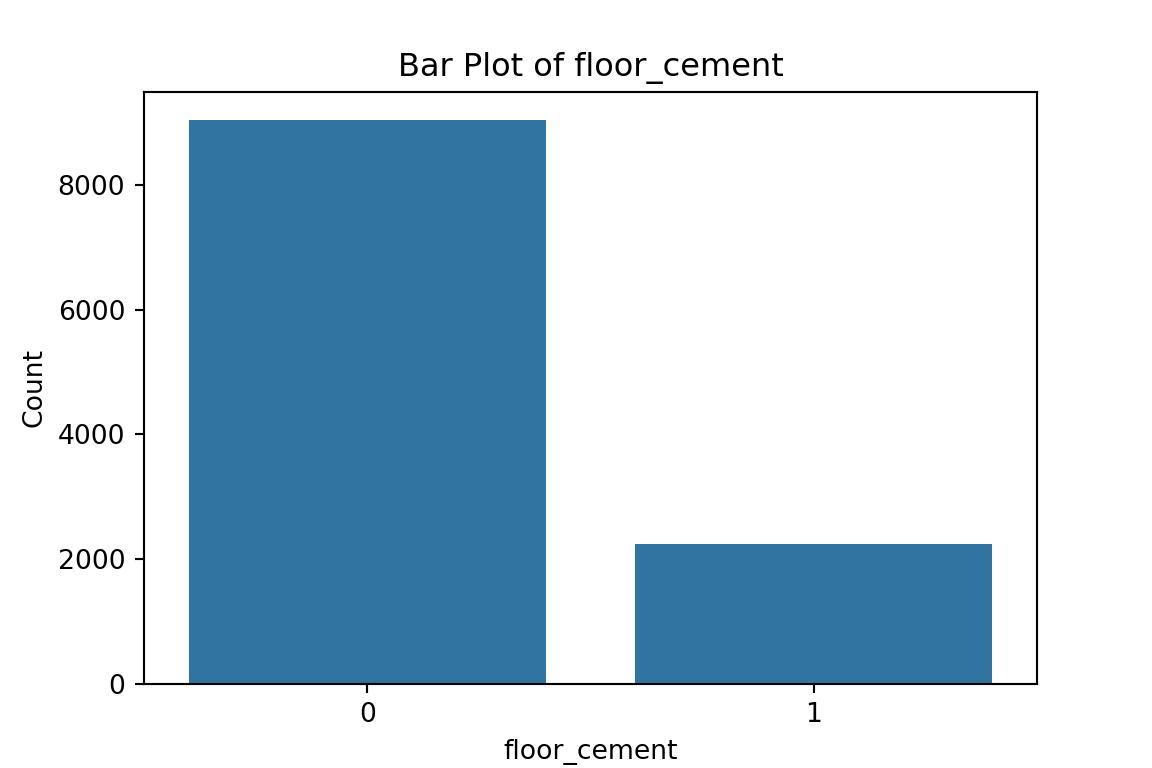

$floor_cement

0 1

9036 2244

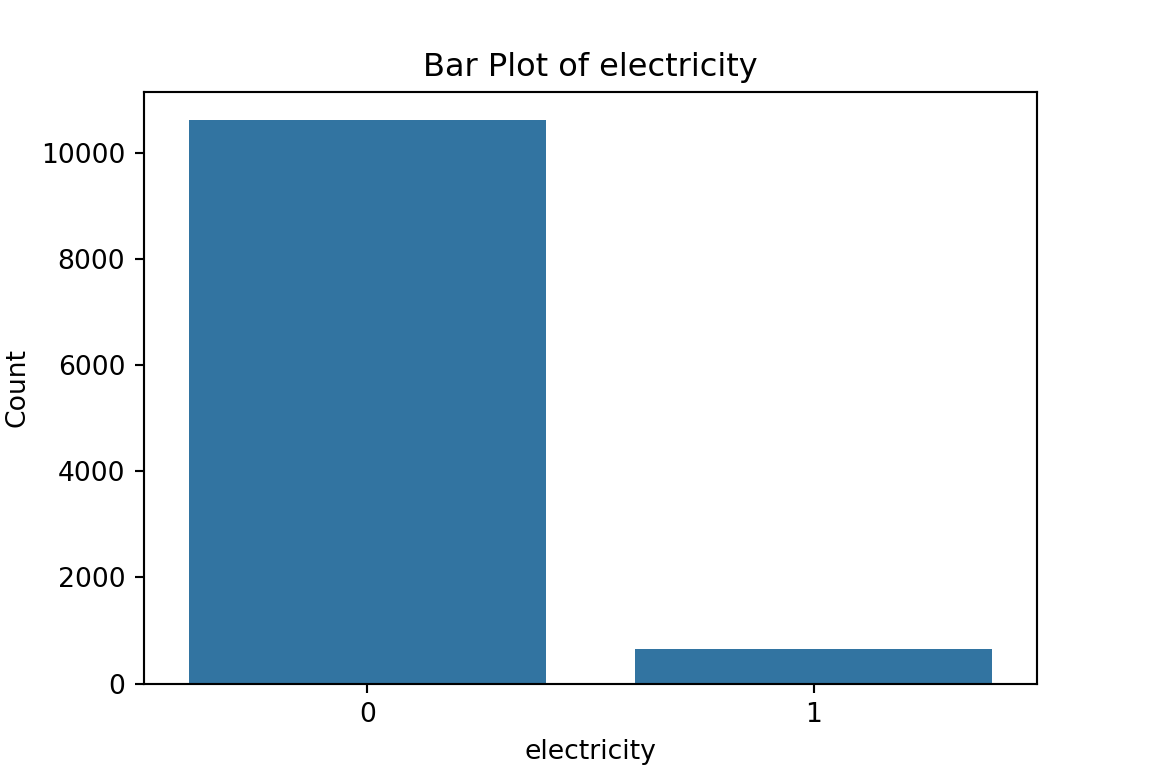

$electricity

0 1

10620 660

$flushtoilet

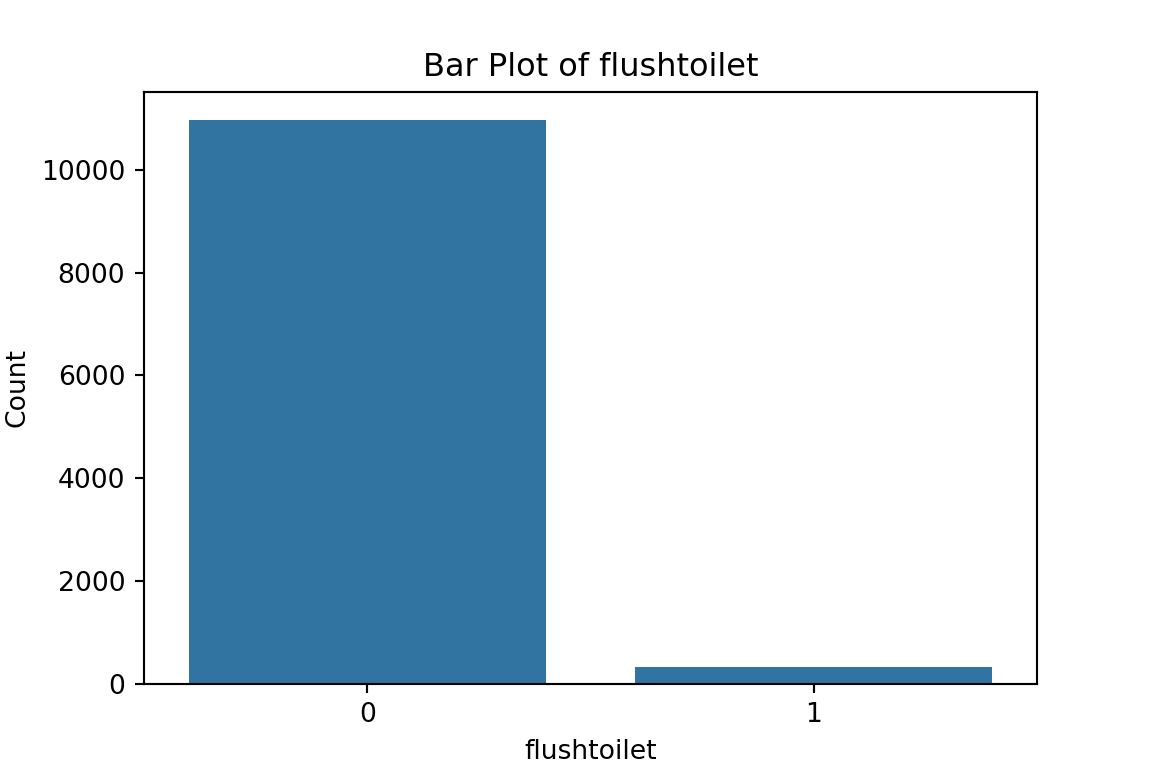

0 1

10962 318

$soap

0 1

9740 1540

$bed

0 1

7653 3627

$bike

0 1

7194 4086

$musicplayer

0 1

9426 1854

$coffeetable

0 1

9956 1324

$iron

0 1

8962 2318

$dimbagarden

0 1

7658 3622

$goats

0 1

8856 2424

$hfem

0 1

8697 2583

$grassroof

0 1

2953 8327

$mortarpestle

0 1

5635 5645

$table

0 1

7249 4031

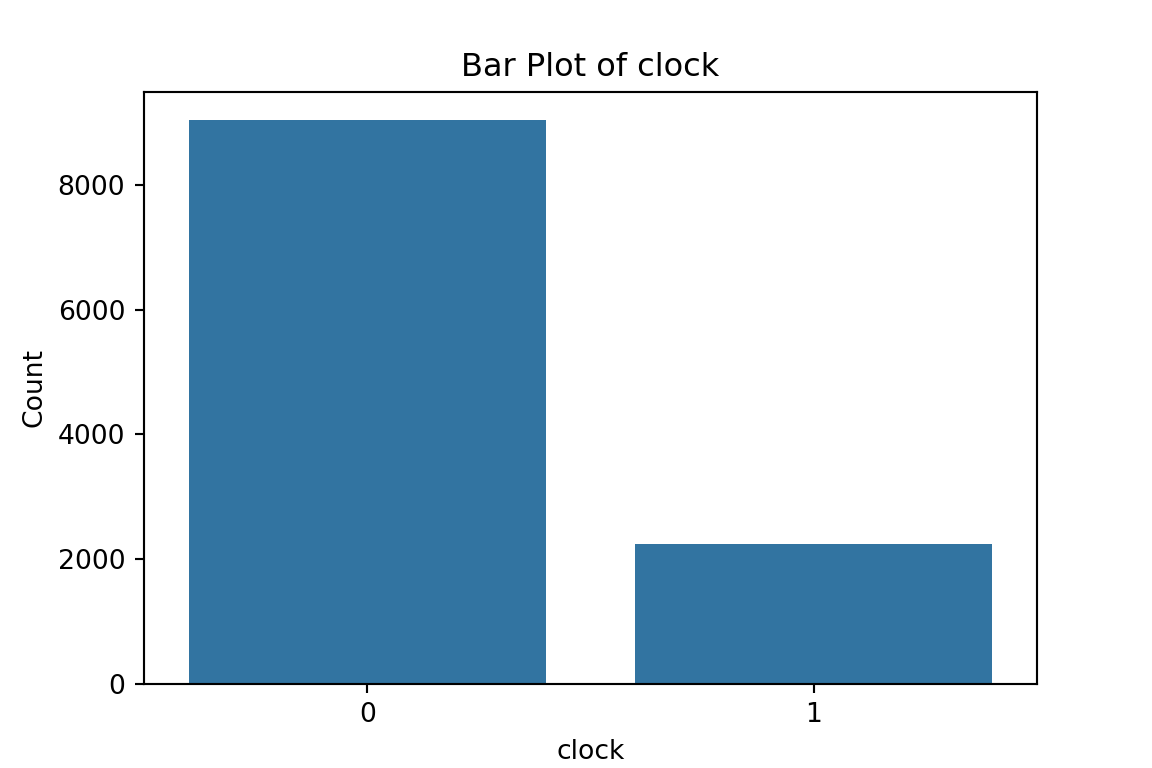

$clock

0 1

9039 2241

$region

Centre North South

4320 1680 5280 What have we learned from the data visualisation?

Nothing worrying about the data itself. McBride and Nichols did a good job of pre-processing the data for us. No pesky missing values, or unknown categories.

From the bar plots, we can see that for the most part, people tend not to own assets. Worryingly, there is a lack of soap, flush toilets and electricity, all of which are crucial for human capital (health and education).

From the histograms, we can see log per capita expenditure is normally distributed, but if we remove the log, it’s incredibly skewed. Poverty is endemic. Households tend not to have too many educated individuals, and their size is non-trivially large (with less rooms than people need).

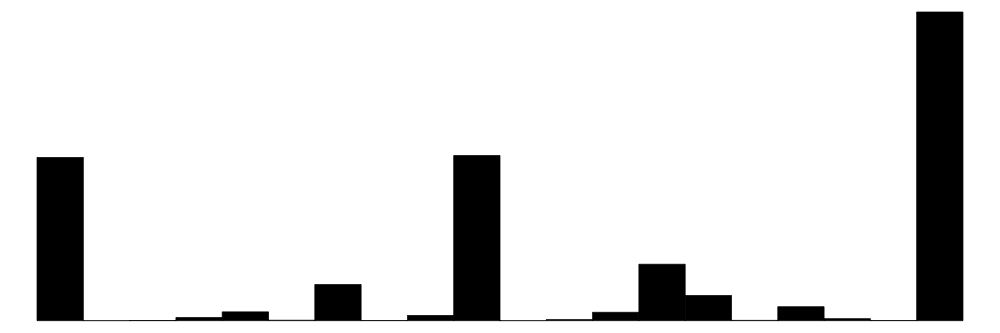

Relationships between features

To finalise our exploration of the dataset, we should define:

the target variable (a.k.a. outcome of interest)

correlational insights

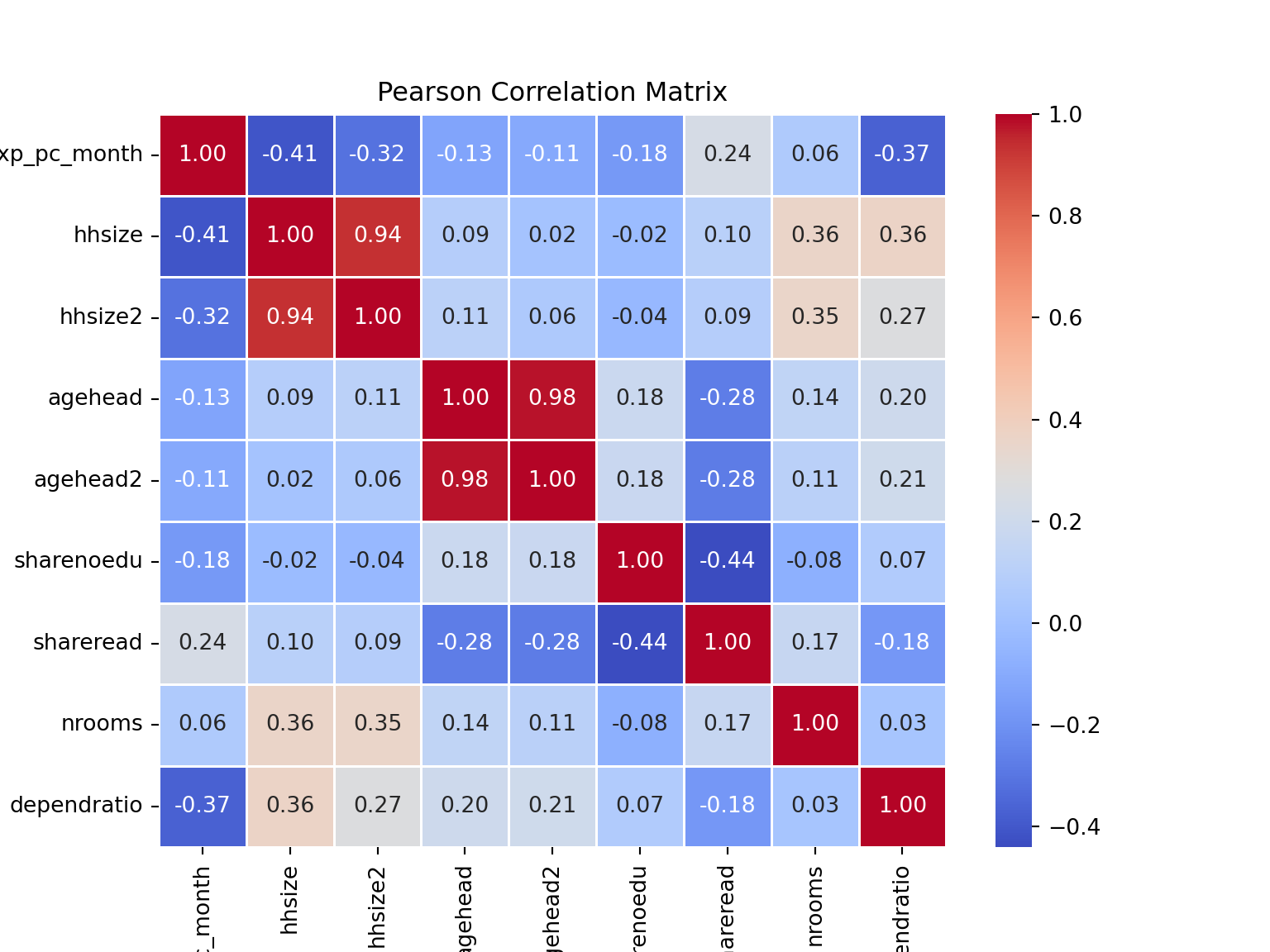

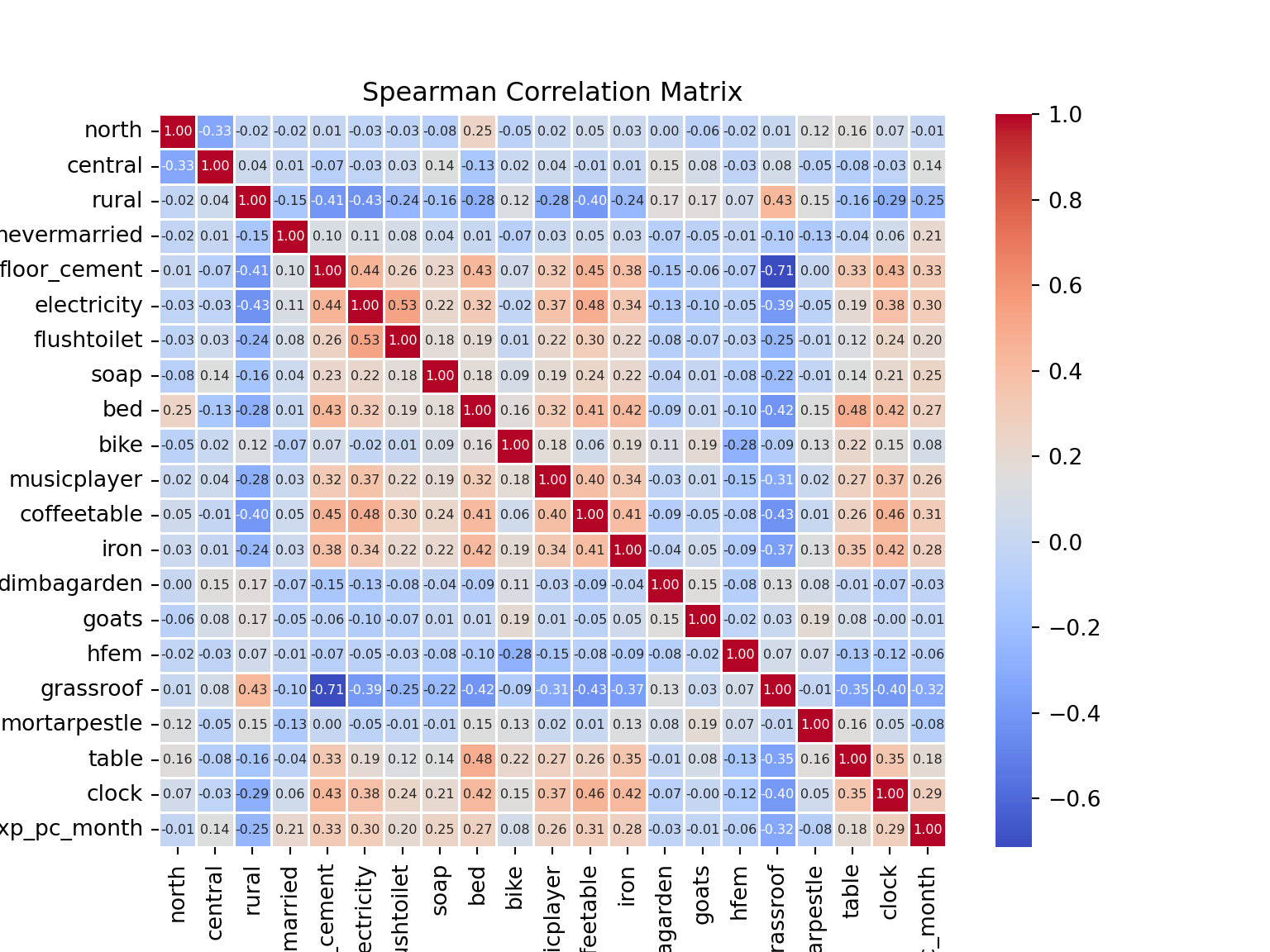

Let’s visualise two distinct correlation matrices; for our numeric dataframe, which includes our target variable, we will plot a Pearson r correlation matrix. For our factor dataframe, to which we will add our continuous target, we will plot a Spearman rho correlation matrix. Both types of correlation coefficients are interpreted the same (0 = no correlation, 1 perfect positive correlation, -1 perfect negative correlation).

# = = PEARSON CORRELATION MATRIX = = #

M <- cor(malawi_continuous) # create a correlation matrix of the continuous dataset, cor() uses Pearson's correlation coefficient as default. This means we can only take the correlation between continuous variables

corrplot(M, method="circle", addCoef.col ="black", number.cex = 0.8) # visualise it in a nice way

We can already tell that the size of the household and dependent ratio are highly negatively correlated to our target variable.

# = = SPEARMAN CORRELATION MATRIX = = #

malawi_factorC <- as.data.frame(lapply(malawi_factor,as.numeric)) # coerce dataframe to numeric, as the cor() command only takes in numeric types

malawi_factorC$lnexp_pc_month <- malawi_continuous$lnexp_pc_month # include target variable in the dataframe

M2 <- cor(malawi_factorC, method = "spearman")

corrplot(M2, method="circle", addCoef.col ="black", number.cex = 0.3) # visualise it in a nice way

Ownership of some assets stands out: soap, a cement floor, electricity, a bed… ownership of these (and a couple of other) assets is positively correlated to per capita expenditure. Living in a rural area, on the other hand, is negtively correlated to our target variable.

We can also spot some correlation coefficients that equal zero. In some situations, the data generating mechanism can create predictors that only have a single unique value (i.e. a “zero-variance predictor”). For many ML models (excluding tree-based models), this may cause the model to crash or the fit to be unstable. Here, the only \(0\) we’ve spotted is not in relation to our target variable.

But we do observe some near-zero-variance predictors. Besides uninformative, these can also create unstable model fits. There’s a few strategies to deal with these; the quickest solution is to remove them. A second option, which is especially interesting in scenarios with a large number of predictors/variables, is to work with penalised models. We’ll discuss this option below.

Pandas is a very complete package to manipulate DataFrames/datasets.

# first observations of dataframe

malawi.head() lnexp_pc_month hhsize hhsize2 ... strataid lnzline case_id

0 6.900896 7 49 ... 1 7.555 10101002025

1 7.064378 3 9 ... 1 7.555 10101002051

2 6.823851 6 36 ... 1 7.555 10101002072

3 6.894722 6 36 ... 1 7.555 10101002079

4 6.465989 6 36 ... 1 7.555 10101002095

[5 rows x 38 columns]# descriptive statistics of variables

malawi.describe() lnexp_pc_month hhsize ... lnzline case_id

count 11280.000000 11280.000000 ... 1.128000e+04 1.128000e+04

mean 7.358888 4.546809 ... 7.555000e+00 2.372322e+10

std 0.675346 2.335525 ... 1.776436e-15 7.241514e+09

min 4.776855 1.000000 ... 7.555000e+00 1.010100e+10

25% 6.892941 3.000000 ... 7.555000e+00 2.040204e+10

50% 7.305191 4.000000 ... 7.555000e+00 2.090352e+10

75% 7.757587 6.000000 ... 7.555000e+00 3.053301e+10

max 11.063562 27.000000 ... 7.555000e+00 3.120209e+10

[8 rows x 36 columns]# now let's summarise the dataframe in a general format

malawi.info()<class 'pandas.core.frame.DataFrame'>

RangeIndex: 11280 entries, 0 to 11279

Data columns (total 38 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 lnexp_pc_month 11280 non-null float64

1 hhsize 11280 non-null int64

2 hhsize2 11280 non-null int64

3 agehead 11280 non-null int64

4 agehead2 11280 non-null int64

5 north 11280 non-null int64

6 central 11280 non-null int64

7 rural 11280 non-null int64

8 nevermarried 11280 non-null int64

9 sharenoedu 11280 non-null float64

10 shareread 11280 non-null float64

11 nrooms 11280 non-null int64

12 floor_cement 11280 non-null int64

13 electricity 11280 non-null int64

14 flushtoilet 11280 non-null int64

15 soap 11280 non-null int64

16 bed 11280 non-null int64

17 bike 11280 non-null int64

18 musicplayer 11280 non-null int64

19 coffeetable 11280 non-null int64

20 iron 11280 non-null int64

21 dimbagarden 11280 non-null int64

22 goats 11280 non-null int64

23 dependratio 11280 non-null float64

24 hfem 11280 non-null int64

25 grassroof 11280 non-null int64

26 mortarpestle 11280 non-null int64

27 table 11280 non-null int64

28 clock 11280 non-null int64

29 ea 11280 non-null int64

30 EA 11280 non-null int64

31 hhwght 11280 non-null float64

32 region 11280 non-null object

33 eatype 11280 non-null object

34 psu 11280 non-null int64

35 strataid 11280 non-null int64

36 lnzline 11280 non-null float64

37 case_id 11280 non-null int64

dtypes: float64(6), int64(30), object(2)

memory usage: 3.3+ MBThe dataset contains 38 variables and 11,280 observations.

Not all of these variables are relevant for our prediction model.

To find the labels and description of the variables, you can refer to the paper.

[hhsize, hhsize2, age_head, age_head2, regions, rural, never married, share_of_adults_without_education, share_of_adults_who_can_read, number of rooms, cement floor, electricity, flush toilet, soap, bed, bike, music player, coffee table, iron, garden, goats]

- Luckily for us, we have no missing values (Non-Null Count in info() output)!

Many machine learning models cannot be trained when missing values are present (some exceptions exist).

Dealing with missingness is a non-trivial task: First and foremost, we should assess whether there is a pattern to missingness and if so, what that means to what we can learn from our (sub)population. If there is no discernible pattern, we can proceed to delete the missing values or impute them. A more detailed explanation and course of action can be found here.

Feature selection: subsetting the dataset

As part of our data pre-processing we will subset the dataframe, such that only relevant variables are left. * Relevant: variables/features about a household/individual that could help us determine whether they are in poverty. That way, we save some memory space; but also, we can call the full set of variables in a dataframe in one go!

variables to delete (not included in the identified set above): [ea, EA, hhwght, psu, strataid, lnzline, case_id, eatype]

N/B: Feature selection is a critical process (and we normally don’t have a paper to guide us through it): from a practical point of view, a model with less predictors may be easier to interpret. Also, some models may be negatively affected by non-informative predictors. This process is similar to traditional econometric modelling, but we should not conflate predictive and causal modelling. Importantly, please note that we are not interested in knowing why something happens, but rather in what is likely to happen given some known data. Hence:

# deleting variables from pandas dataframe

cols2delete = ['ea', 'EA', 'hhwght', 'psu', 'strataid', 'lnzline', 'case_id', 'eatype', 'region']

malawi = malawi.drop(cols2delete,axis=1) # axis=0 means delete rows and axis=1 means delete columns

# check if we have deleted the columns:

print(malawi.shape)(11280, 29)Same number of rows, but only 29 variables left. We have succesfully deleted those pesky unwanted vectors!

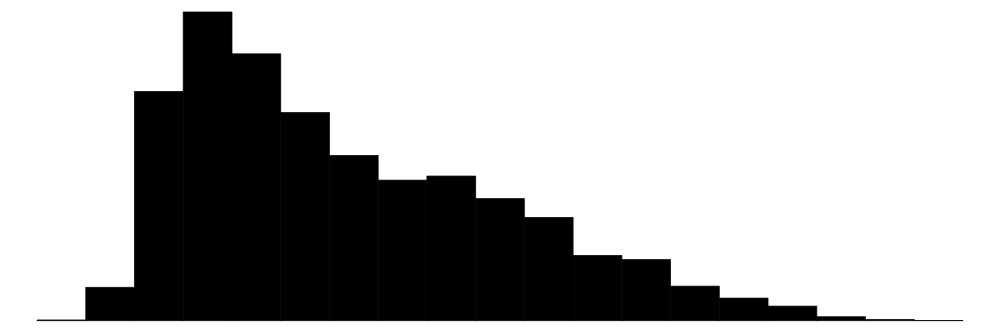

Data visualisation

A quick and effective way to take a first glance at our data is to plot histograms of relevant features. We can use the seaborn and matplotlib libraries to visualise our dataframe.

- The distribution of each variable matters for the type of plot

- start by looking at the number of unique values

- if unique values <= 3 you are certain this is a categorical variable, and from our exploration using malawi.info() we had only integer/floats…

# print numbr of unique values by vector

malawi.nunique()lnexp_pc_month 11266

hhsize 19

hhsize2 19

agehead 88

agehead2 88

north 2

central 2

rural 2

nevermarried 2

sharenoedu 47

shareread 28

nrooms 16

floor_cement 2

electricity 2

flushtoilet 2

soap 2

bed 2

bike 2

musicplayer 2

coffeetable 2

iron 2

dimbagarden 2

goats 2

dependratio 62

hfem 2

grassroof 2

mortarpestle 2

table 2

clock 2

dtype: int64print(" There's a large number of variables with 2 unique values. We can plot numeric/continuous variables as histograms and binary variables as bar plots.") There's a large number of variables with 2 unique values. We can plot numeric/continuous variables as histograms and binary variables as bar plots.# for-loop that iterates over variables in dataframe, if they have 2 unique values, transform vector into categorical

for column in malawi:

if malawi[column].nunique() == 2:

malawi[column] = pd.Categorical(malawi[column])

# check if it worked

malawi.info() # hooray! we've got integers, floats (numerics), and categorical variables now. <class 'pandas.core.frame.DataFrame'>

RangeIndex: 11280 entries, 0 to 11279

Data columns (total 29 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 lnexp_pc_month 11280 non-null float64

1 hhsize 11280 non-null int64

2 hhsize2 11280 non-null int64

3 agehead 11280 non-null int64

4 agehead2 11280 non-null int64

5 north 11280 non-null category

6 central 11280 non-null category

7 rural 11280 non-null category

8 nevermarried 11280 non-null category

9 sharenoedu 11280 non-null float64

10 shareread 11280 non-null float64

11 nrooms 11280 non-null int64

12 floor_cement 11280 non-null category

13 electricity 11280 non-null category

14 flushtoilet 11280 non-null category

15 soap 11280 non-null category

16 bed 11280 non-null category

17 bike 11280 non-null category

18 musicplayer 11280 non-null category

19 coffeetable 11280 non-null category

20 iron 11280 non-null category

21 dimbagarden 11280 non-null category

22 goats 11280 non-null category

23 dependratio 11280 non-null float64

24 hfem 11280 non-null category

25 grassroof 11280 non-null category

26 mortarpestle 11280 non-null category

27 table 11280 non-null category

28 clock 11280 non-null category

dtypes: category(20), float64(4), int64(5)

memory usage: 1016.0 KB# plot histograms or bar graphs for each of the columns in the dataframe, print them all in the same grid

# subset of numeric/continuous

numeric_df = malawi.select_dtypes(include=['float64', 'int64'])

numeric_df.shape # dataframe subset contains only 9 variables(11280, 9)# plot histograms of all variables in numeric dataframe (df)

for column in numeric_df.columns:

plt.figure(figsize=(3, 1)) # Adjust figsize as needed

sns.histplot(numeric_df[column], bins=20, kde=True)

plt.title(f'Histogram of {column}')

plt.xlabel(column)

plt.ylabel('Count')

plt.show()

We can apply a similar logic to plotting/visualising categorical data: bar graphs, but also tables work well.

# subset of categorical data

cat_df = malawi.select_dtypes(include=['category'])

cat_df.shape # dataframe subset contains 20 variables (11280, 20)# let's start with printing tables of the 20 variables with category/count

for column in cat_df.columns:

table = pd.crosstab(index=cat_df[column], columns='count')

print(f'Table for {column}:\n{table}\n')Table for north:

col_0 count

north

0 9600

1 1680

Table for central:

col_0 count

central

0 6960

1 4320

Table for rural:

col_0 count

rural

0 1440

1 9840

Table for nevermarried:

col_0 count

nevermarried

0 10930

1 350

Table for floor_cement:

col_0 count

floor_cement

0 9036

1 2244

Table for electricity:

col_0 count

electricity

0 10620

1 660

Table for flushtoilet:

col_0 count

flushtoilet

0 10962

1 318

Table for soap:

col_0 count

soap

0 9740

1 1540

Table for bed:

col_0 count

bed

0 7653

1 3627

Table for bike:

col_0 count

bike

0 7194

1 4086

Table for musicplayer:

col_0 count

musicplayer

0 9426

1 1854

Table for coffeetable:

col_0 count

coffeetable

0 9956

1 1324

Table for iron:

col_0 count

iron

0 8962

1 2318

Table for dimbagarden:

col_0 count

dimbagarden

0 7658

1 3622

Table for goats:

col_0 count

goats

0 8856

1 2424

Table for hfem:

col_0 count

hfem

0 8697

1 2583

Table for grassroof:

col_0 count

grassroof

0 2953

1 8327

Table for mortarpestle:

col_0 count

mortarpestle

0 5635

1 5645

Table for table:

col_0 count

table

0 7249

1 4031

Table for clock:

col_0 count

clock

0 9039

1 2241

# maybe bar graphs for a quick visual check of asset ownership scarcity?

for column in cat_df.columns:

plt.figure(figsize=(6, 4))

sns.countplot(x=column, data=cat_df)

plt.title(f'Bar Plot of {column}')

plt.xlabel(column)

plt.ylabel('Count')

plt.show()

What have we learned from the data visualisation?

Nothing worrying about the data itself. McBride and Nichols did a good job of pre-processing the data for us. No pesky missing values, or unknown categories.

From the bar plots, we can see that for the most part, people tend not to own assets. Worryingly, there is a lack of soap, flush toilets and electricity, all of which are crucial for human capital (health and education).

From the histograms, we can see log per capita expenditure is normally distributed, but if we remove the log, it’s incredibly skewed. Poverty is endemic. Furthermore, households tend not to have too many educated individuals, and household size is non-trivially large (with less rooms than people need).

Relationships between features

To finalise our exploration of the dataset, we should define:

the target variable (a.k.a. outcome of interest)

correlational insights

Let’s visualise two distinct correlation matrices; for our numeric dataframe, which includes our target variable, we will plot a Pearson r correlation matrix. For our factor dataframe, to which we will add our continuous target, we will plot a Spearman rho correlation matrix. Both types of correlation coefficients are interpreted the same (0 = no correlation, 1 perfect positive correlation, -1 perfect negative correlation).

# Pearson correlation matrix (seaborn and matplotlib libraries again :))

correlation_matrix = numeric_df.corr() # Pearson correlation for continuously disributed variables (default method is pearson)

# plot it to get a nice visual

plt.figure(figsize=(8, 6))

sns.heatmap(correlation_matrix, annot=True, cmap='coolwarm', fmt='.2f', linewidths=0.5)

plt.title('Pearson Correlation Matrix')

plt.show()

# Spearman correlation matrix

# unfortunately, only numeric values can be used in corr()

# detour: transform categorical into numeric type...

for column in cat_df.columns:

if pd.api.types.is_categorical_dtype(cat_df[column]):

cat_df[column] = cat_df[column].cat.codes<string>:6: DeprecationWarning: is_categorical_dtype is deprecated and will be removed in a future version. Use isinstance(dtype, pd.CategoricalDtype) insteadcat_df.info() # all integers now! hooray!<class 'pandas.core.frame.DataFrame'>

RangeIndex: 11280 entries, 0 to 11279

Data columns (total 20 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 north 11280 non-null int8

1 central 11280 non-null int8

2 rural 11280 non-null int8

3 nevermarried 11280 non-null int8

4 floor_cement 11280 non-null int8

5 electricity 11280 non-null int8

6 flushtoilet 11280 non-null int8

7 soap 11280 non-null int8

8 bed 11280 non-null int8

9 bike 11280 non-null int8

10 musicplayer 11280 non-null int8

11 coffeetable 11280 non-null int8

12 iron 11280 non-null int8

13 dimbagarden 11280 non-null int8

14 goats 11280 non-null int8

15 hfem 11280 non-null int8

16 grassroof 11280 non-null int8

17 mortarpestle 11280 non-null int8

18 table 11280 non-null int8

19 clock 11280 non-null int8

dtypes: int8(20)

memory usage: 220.4 KB# detour 2: concatenate target variable to our categorical dataframe

targetvar = malawi['lnexp_pc_month']

cat_df_new = pd.concat([cat_df, targetvar], axis=1) # recall axis=1 tells python to concatenate the column

spearman_matrix = cat_df_new.corr(method='spearman') # specify method spearman

# visualise spearman correlation matrix

plt.figure(figsize=(8, 6))

sns.heatmap(spearman_matrix, annot=True, cmap='coolwarm', fmt='.2f', linewidths=0.5, annot_kws={'size': 6})

plt.title('Spearman Correlation Matrix')

plt.show()

Ideally, we would print a correlation matrix with ALL the variables. For display purposes, we’ve separated them here. If we were interested in relationships between two variables that are not our target variable, we may want to think about a full correlation matrix.

From the Pearson Correlation Matrix, we can see that the size of the household and dependent ratio are highly negatively correlated to our target variable.

From the Spearman Correlation Matrix, we see that ownership of some assets stands out: soap, a cement floor, electricity, a bed… ownership of these (and a couple of other) assets is positively correlated to per capita expenditure. Living in a rural area, on the other hand, is negtively correlated to our target variable.

We can also spot some correlation coefficients that equal zero. In some situations, the data generating mechanism can create predictors that only have a single unique value (i.e. a “zero-variance predictor”). For many ML models (excluding tree-based models), this may cause the model to crash or the fit to be unstable. Here, the only \(0\) we’ve spotted is not in relation to our target variable.

But we do observe some near-zero-variance predictors. Besides uninformative, these can also create unstable model fits. There’s a few strategies to deal with these; the quickest solution is to remove them. A second option, which is especially interesting in scenarios with a large number of predictors/variables, is to work with penalised models. We’ll discuss this option below.

3. Model fit: data partition and performance evaluation parameters

We now have a general idea of the structure of the data we are working with, and what we’re trying to predict: per capita expenditures, which we believe are a proxy for poverty prevalence. Measured by the log of per capita monthly expenditure in our dataset, the variable is named lnexp_pc_month.

The next step is create a simple linear model (OLS) to predict per capita expenditure using the variables in our dataset, and introduce the elements with which we will evaluate our model.

Data Partinioning

When we want to build predictive models for machine learning purposes, it is important to have (at least) two data sets. A training data set from which our model will learn, and a test data set containing the same features as our training data set; we use the second dataset to see how well our predictive model extrapolates to other samples (i.e. is it generalisable?). To split our main data set into two, we will work with an 80/20 split.

The 80/20 split has its origins in the Pareto Principle, which states that ‘in most cases, 80% of effects from from 20% of causes’. Though there are other test/train splitting options, this partitioning method is a good place to start, and indeed standard in the machine learning field.

# First, set a seed to guarantee replicability of the process

set.seed(1234) # you can use any number you want, but to replicate the results in this tutorial you need to use this number

# We could split the data manually, but the caret package includes an useful function

train_idx <- createDataPartition(data_malawi$lnexp_pc_month, p = .8, list = FALSE, times = 1)

head(train_idx) # notice that observation 5 corresponds to resame indicator 7 and so on. We're shuffling and picking! Resample1

[1,] 1

[2,] 2

[3,] 4

[4,] 5

[5,] 7

[6,] 8Train_df <- data_malawi[ train_idx,]

Test_df <- data_malawi[-train_idx,]

# Note that we have created training and testing dataframes as an 80/20 split of the original dataset.# split train and test data using the sci-kit learn library (our go-to machine learning package for now!)

from sklearn.model_selection import train_test_split

# We need to define a matrix X that contains all the features (variables) that we are interested in, and a vector Y that is the target variable

# These two elements should be defined both fur the train and test subsets of our data

X = malawi.iloc[:, 1:28] # x is a matrix containing all vectors/variables except the first one, which conveniently is our target variable

# recall that python starts counting at 0, therefore vector in position 0 = vector 1, vector in position 1 = vector 2, etc.

y = malawi.iloc[:, 0] # y is a vector containing our target variable

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=12345) # random_state is for reproducibility purposes, analogous to setting a seed in R.

X_train.head(3) hhsize hhsize2 agehead agehead2 ... hfem grassroof mortarpestle table

9867 5 25 41 1681 ... 1 0 1 1

3782 5 25 41 1681 ... 0 1 1 0

5647 5 25 55 3025 ... 0 0 1 1

[3 rows x 27 columns]X_test.head(3) hhsize hhsize2 agehead agehead2 ... hfem grassroof mortarpestle table

3750 2 4 48 2304 ... 1 1 0 0

9030 3 9 42 1764 ... 0 1 1 1

3239 2 4 26 676 ... 0 1 0 0

[3 rows x 27 columns]print(y_train)9867 8.504023

3782 6.688002

5647 7.287024

7440 5.643893

7283 6.706208

...

4478 8.266976

4094 8.688864

3492 7.312614

2177 7.538856

4578 6.676927

Name: lnexp_pc_month, Length: 9024, dtype: float64print(y_test)3750 7.936020

9030 7.464896

3239 7.288868

1463 7.816436

11236 6.859672

...

8570 7.232218

11080 7.318853

7124 9.199136

8818 7.928102

3167 7.507953

Name: lnexp_pc_month, Length: 2256, dtype: float64

# everything looks okay, let's proceed with modelling... Prediction with Linear Models

We will start by fitting a predictive model using the training dataset; that is, our target variable log of monthly per capita expenditures or lnexp_pc_month will be a \(Y\) dependent variable in a linear model \(Y_i = \alpha + x'\beta_i + \epsilon_i\), and the remaining features in the data frame correspond to the row vectors \(x'\beta\).

model1 <- lm(lnexp_pc_month ~ .,Train_df) # the dot after the squiggle ~ asks the lm() function tu use all other variables in the dataframe as predictors to the dependent variable lnexp_pc_month

stargazer(model1, type = "text") # printed in the console as text

===============================================

Dependent variable:

---------------------------

lnexp_pc_month

-----------------------------------------------

hhsize -0.292***

(0.006)

hhsize2 0.012***

(0.0005)

agehead 0.003

(0.002)

agehead2 -0.00004**

(0.00002)

northNorth 0.080***

(0.014)

central1 0.252***

(0.010)

rural1 -0.055***

(0.017)

nevermarried1 0.271***

(0.028)

sharenoedu -0.105***

(0.020)

shareread 0.075***

(0.015)

nrooms 0.039***

(0.004)

floor_cement1 0.102***

(0.017)

electricity1 0.372***

(0.027)

flushtoilet1 0.329***

(0.033)

soap1 0.215***

(0.014)

bed1 0.104***

(0.013)

bike1 0.094***

(0.011)

musicplayer1 0.111***

(0.015)

coffeetable1 0.137***

(0.019)

iron1 0.130***

(0.014)

dimbagarden1 0.102***

(0.010)

goats1 0.080***

(0.012)

dependratio -0.045***

(0.006)

hfem1 -0.066***

(0.012)

grassroof1 -0.096***

(0.016)

mortarpestle1 0.033***

(0.010)

table1 0.051***

(0.011)

clock1 0.058***

(0.014)

regionNorth

regionSouth

Constant 7.978***

(0.044)

-----------------------------------------------

Observations 9,024

R2 0.599

Adjusted R2 0.597

Residual Std. Error 0.428 (df = 8995)

F Statistic 479.041*** (df = 28; 8995)

===============================================

Note: *p<0.1; **p<0.05; ***p<0.01# We can also estimate iid and robust standard errors, using the model output package modelsummary()

ms <- modelsummary(model1,

vcov = list("iid","robust"), # include iid and HC3 (robust) standard errors

statistic = c("p = {p.value}","s.e. = {std.error}"),

stars = TRUE,

output = "gt"

) # plotted as an image / object in "gt" format

ms %>% tab_header(

title = md("**Linear Models with iid and robust s.e.**"),

subtitle = md("Target: (log) per capita monthly expenditure")

)| Linear Models with iid and robust s.e. | ||

|---|---|---|

| Target: (log) per capita monthly expenditure | ||

| (1) | (2) | |

| (Intercept) | 7.978*** | 7.978*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.044 | s.e. = 0.069 | |

| hhsize | -0.292*** | -0.292*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.006 | s.e. = 0.029 | |

| hhsize2 | 0.012*** | 0.012*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.000 | s.e. = 0.003 | |

| agehead | 0.003 | 0.003 |

| p = 0.108 | p = 0.137 | |

| s.e. = 0.002 | s.e. = 0.002 | |

| agehead2 | -0.000* | -0.000* |

| p = 0.015 | p = 0.032 | |

| s.e. = 0.000 | s.e. = 0.000 | |

| northNorth | 0.080*** | 0.080*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.014 | s.e. = 0.015 | |

| central1 | 0.252*** | 0.252*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.010 | s.e. = 0.010 | |

| rural1 | -0.055** | -0.055** |

| p = 0.001 | p = 0.001 | |

| s.e. = 0.017 | s.e. = 0.017 | |

| nevermarried1 | 0.271*** | 0.271*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.028 | s.e. = 0.037 | |

| sharenoedu | -0.105*** | -0.105*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.020 | s.e. = 0.021 | |

| shareread | 0.075*** | 0.075*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.015 | s.e. = 0.015 | |

| nrooms | 0.039*** | 0.039*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.004 | s.e. = 0.004 | |

| floor_cement1 | 0.102*** | 0.102*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.017 | s.e. = 0.018 | |

| electricity1 | 0.372*** | 0.372*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.027 | s.e. = 0.029 | |

| flushtoilet1 | 0.329*** | 0.329*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.033 | s.e. = 0.042 | |

| soap1 | 0.215*** | 0.215*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.014 | s.e. = 0.014 | |

| bed1 | 0.104*** | 0.104*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.013 | s.e. = 0.013 | |

| bike1 | 0.094*** | 0.094*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.011 | s.e. = 0.011 | |

| musicplayer1 | 0.111*** | 0.111*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.015 | s.e. = 0.015 | |

| coffeetable1 | 0.137*** | 0.137*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.019 | s.e. = 0.019 | |

| iron1 | 0.130*** | 0.130*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.014 | s.e. = 0.014 | |

| dimbagarden1 | 0.102*** | 0.102*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.010 | s.e. = 0.010 | |

| goats1 | 0.080*** | 0.080*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.012 | s.e. = 0.012 | |

| dependratio | -0.045*** | -0.045*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.006 | s.e. = 0.009 | |

| hfem1 | -0.066*** | -0.066*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.012 | s.e. = 0.013 | |

| grassroof1 | -0.096*** | -0.096*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.016 | s.e. = 0.016 | |

| mortarpestle1 | 0.033** | 0.033** |

| p = 0.001 | p = 0.001 | |

| s.e. = 0.010 | s.e. = 0.010 | |

| table1 | 0.051*** | 0.051*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.011 | s.e. = 0.012 | |

| clock1 | 0.058*** | 0.058*** |

| p = <0.001 | p = <0.001 | |

| s.e. = 0.014 | s.e. = 0.014 | |

| Num.Obs. | 9024 | 9024 |

| R2 | 0.599 | 0.599 |

| R2 Adj. | 0.597 | 0.597 |

| AIC | 10317.3 | 10317.3 |

| BIC | 10530.5 | 10530.5 |

| Log.Lik. | -5128.658 | -5128.658 |

| RMSE | 0.43 | 0.43 |

| Std.Errors | IID | HC3 |

| + p < 0.1, * p < 0.05, ** p < 0.01, *** p < 0.001 | ||

You can see that the variable region was not included in the output (this is because we already have dummies of north (not north = south), and central region). We may need to clean our dataset un some further steps.

Recall that one of the assumptions of a linear model is that errors are independent and identically distributed. We could run some tests to determine this, but with the contrast of the iid and robust errors (HC3) in the modelsummary output table we can already tell that this is not an issue/something to worry about in our estimations.

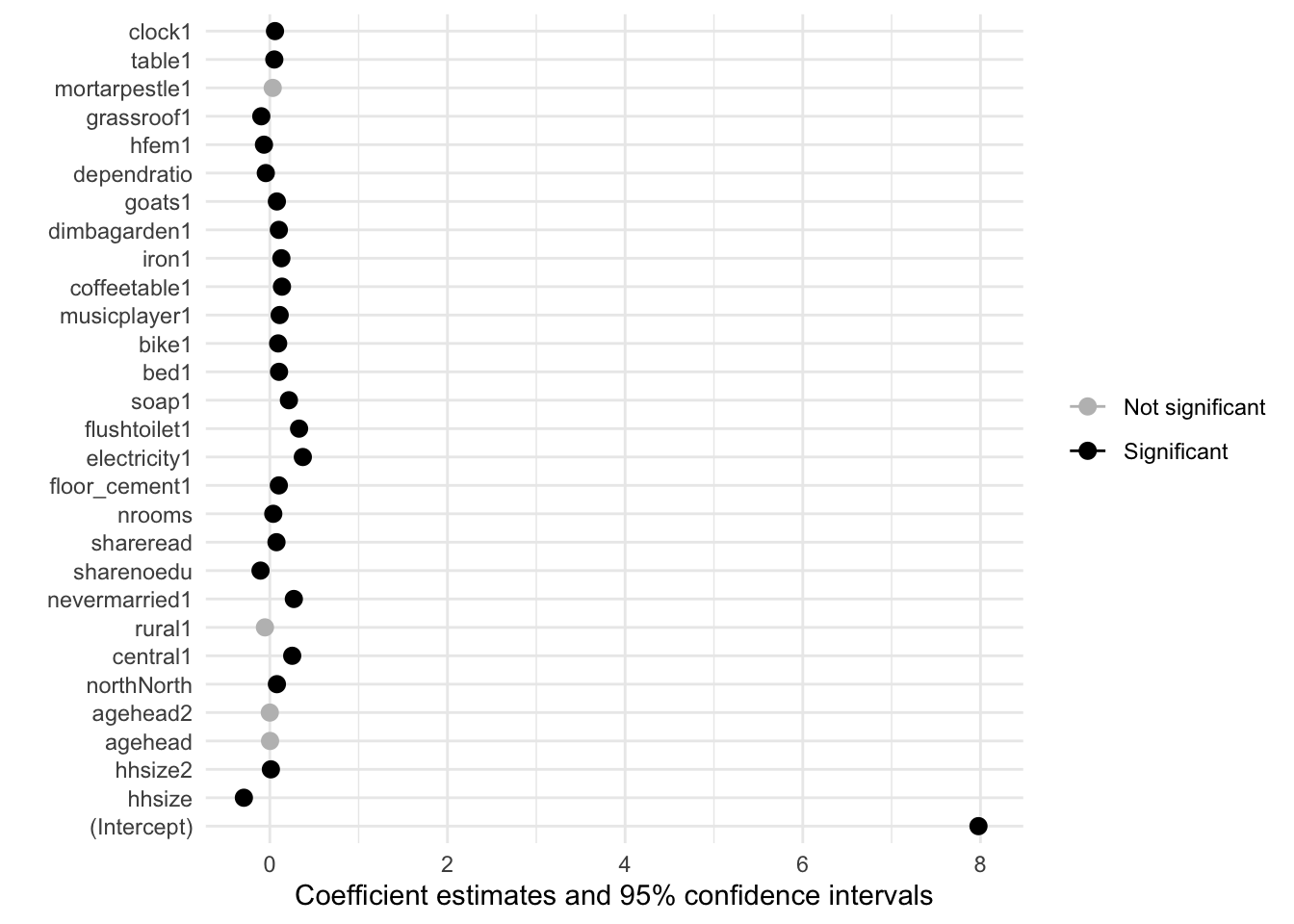

Besides the regression output table, we can can also visualise the magnitude and significance of the coefficients with a plot. The further away the variable (dot) marker is from the \(0\) line, the larger the magnitude.

modelplot(model1) +

aes(color = ifelse(p.value < 0.001, "Significant", "Not significant")) +

scale_color_manual(values = c("grey", "black")

)

# grey points indicate statistically insignificat (p>0.001) coefficient estimates

# The scale of the plot is large due to the intercept estimateNot unlike what we saw in out correlation matrix, household size, electricity, having a flush toilet… the magnitude of the impact of these variables on monthly per capita expenditure is significantly larger than that of other assets/predictors.

# Importing more features from the scikit-learn package

from sklearn.linear_model import LinearRegression

model1 = LinearRegression(fit_intercept=True).fit(X_train, y_train)

# visualise the output from the linear model

print(f'Coefficients: {model1.coef_}')Coefficients: [-2.88803518e-01 1.16454588e-02 4.00549713e-03 -5.26522790e-05

7.46404592e-02 2.59743764e-01 -5.70197786e-02 2.68613159e-01

-1.10722935e-01 8.48179021e-02 3.97403945e-02 1.22016217e-01

3.86242046e-01 3.64921504e-01 2.08221283e-01 1.15598316e-01

9.77483503e-02 1.12175940e-01 1.35028702e-01 1.38280053e-01

9.19268361e-02 8.76979599e-02 -4.31108804e-02 -7.06557671e-02

-8.59920259e-02 2.97336875e-02 5.09616025e-02]print(f'Intercept: {model1.intercept_}')Intercept: 7.928626868102188# visualise in a nice way (using the statsmodel.api library)

X_train_with_constant = sm.add_constant(X_train) # add a constant to the X feature matrix

ols_model = sm.OLS(y_train, X_train_with_constant) # use the statsmodel OLS function to regress X features on Y vector

# Fit the OLS model

lm_results = ols_model.fit()

# Display the summary

print(lm_results.summary()) OLS Regression Results

==============================================================================

Dep. Variable: lnexp_pc_month R-squared: 0.599

Model: OLS Adj. R-squared: 0.598

Method: Least Squares F-statistic: 498.3

Date: Thu, 03 Apr 2025 Prob (F-statistic): 0.00

Time: 12:06:47 Log-Likelihood: -5189.2

No. Observations: 9024 AIC: 1.043e+04

Df Residuals: 8996 BIC: 1.063e+04

Df Model: 27

Covariance Type: nonrobust

================================================================================

coef std err t P>|t| [0.025 0.975]

--------------------------------------------------------------------------------

const 7.9286 0.044 179.409 0.000 7.842 8.015

hhsize -0.2888 0.006 -44.577 0.000 -0.302 -0.276

hhsize2 0.0116 0.000 24.092 0.000 0.011 0.013

agehead 0.0040 0.002 2.327 0.020 0.001 0.007

agehead2 -5.265e-05 1.72e-05 -3.058 0.002 -8.64e-05 -1.89e-05

north 0.0746 0.014 5.156 0.000 0.046 0.103

central 0.2597 0.010 25.294 0.000 0.240 0.280

rural -0.0570 0.017 -3.384 0.001 -0.090 -0.024

nevermarried 0.2686 0.028 9.519 0.000 0.213 0.324

sharenoedu -0.1107 0.020 -5.450 0.000 -0.151 -0.071

shareread 0.0848 0.015 5.622 0.000 0.055 0.114

nrooms 0.0397 0.004 9.707 0.000 0.032 0.048

floor_cement 0.1220 0.017 7.012 0.000 0.088 0.156

electricity 0.3862 0.027 14.506 0.000 0.334 0.438

flushtoilet 0.3649 0.032 11.365 0.000 0.302 0.428

soap 0.2082 0.014 14.720 0.000 0.180 0.236

bed 0.1156 0.013 8.933 0.000 0.090 0.141

bike 0.0977 0.011 9.108 0.000 0.077 0.119

musicplayer 0.1122 0.014 7.787 0.000 0.084 0.140

coffeetable 0.1350 0.018 7.483 0.000 0.100 0.170

iron 0.1383 0.014 10.093 0.000 0.111 0.165

dimbagarden 0.0919 0.010 9.003 0.000 0.072 0.112

goats 0.0877 0.012 7.428 0.000 0.065 0.111

dependratio -0.0431 0.006 -7.396 0.000 -0.055 -0.032

hfem -0.0707 0.012 -5.687 0.000 -0.095 -0.046

grassroof -0.0860 0.016 -5.498 0.000 -0.117 -0.055

mortarpestle 0.0297 0.010 2.867 0.004 0.009 0.050

table 0.0510 0.012 4.411 0.000 0.028 0.074

==============================================================================

Omnibus: 204.679 Durbin-Watson: 1.992

Prob(Omnibus): 0.000 Jarque-Bera (JB): 314.826

Skew: 0.233 Prob(JB): 4.33e-69

Kurtosis: 3.787 Cond. No. 2.68e+04

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 2.68e+04. This might indicate that there are

strong multicollinearity or other numerical problems.Recall that one of the assumptions of a linear model is that errors are independent and identically distributed. We could run some tests to determine this, but with another quick way to check is to contrast the iid and robust errors (HC3) in the summary output:

lm_robust = sm.OLS(y_train, X_train_with_constant).fit(cov_type='HC3') # HC3 are also known as robust std errors

print(lm_robust.summary()) OLS Regression Results

==============================================================================

Dep. Variable: lnexp_pc_month R-squared: 0.599

Model: OLS Adj. R-squared: 0.598

Method: Least Squares F-statistic: 431.9

Date: Thu, 03 Apr 2025 Prob (F-statistic): 0.00

Time: 12:06:48 Log-Likelihood: -5189.2

No. Observations: 9024 AIC: 1.043e+04

Df Residuals: 8996 BIC: 1.063e+04

Df Model: 27

Covariance Type: HC3

================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------

const 7.9286 0.066 120.963 0.000 7.800 8.057

hhsize -0.2888 0.027 -10.502 0.000 -0.343 -0.235

hhsize2 0.0116 0.002 4.732 0.000 0.007 0.016

agehead 0.0040 0.002 2.181 0.029 0.000 0.008

agehead2 -5.265e-05 1.93e-05 -2.733 0.006 -9.04e-05 -1.49e-05

north 0.0746 0.016 4.727 0.000 0.044 0.106

central 0.2597 0.010 25.600 0.000 0.240 0.280

rural -0.0570 0.017 -3.267 0.001 -0.091 -0.023

nevermarried 0.2686 0.036 7.507 0.000 0.198 0.339

sharenoedu -0.1107 0.021 -5.338 0.000 -0.151 -0.070

shareread 0.0848 0.015 5.587 0.000 0.055 0.115

nrooms 0.0397 0.005 8.706 0.000 0.031 0.049

floor_cement 0.1220 0.018 6.733 0.000 0.086 0.158

electricity 0.3862 0.030 13.071 0.000 0.328 0.444

flushtoilet 0.3649 0.041 8.939 0.000 0.285 0.445

soap 0.2082 0.014 14.659 0.000 0.180 0.236

bed 0.1156 0.013 8.816 0.000 0.090 0.141

bike 0.0977 0.011 9.053 0.000 0.077 0.119

musicplayer 0.1122 0.015 7.607 0.000 0.083 0.141

coffeetable 0.1350 0.019 7.079 0.000 0.098 0.172

iron 0.1383 0.014 10.158 0.000 0.112 0.165

dimbagarden 0.0919 0.010 8.983 0.000 0.072 0.112

goats 0.0877 0.012 7.553 0.000 0.065 0.110

dependratio -0.0431 0.008 -5.189 0.000 -0.059 -0.027

hfem -0.0707 0.013 -5.408 0.000 -0.096 -0.045

grassroof -0.0860 0.015 -5.648 0.000 -0.116 -0.056

mortarpestle 0.0297 0.010 2.856 0.004 0.009 0.050

table 0.0510 0.012 4.313 0.000 0.028 0.074

==============================================================================

Omnibus: 204.679 Durbin-Watson: 1.992

Prob(Omnibus): 0.000 Jarque-Bera (JB): 314.826

Skew: 0.233 Prob(JB): 4.33e-69

Kurtosis: 3.787 Cond. No. 2.68e+04

==============================================================================

Notes:

[1] Standard Errors are heteroscedasticity robust (HC3)

[2] The condition number is large, 2.68e+04. This might indicate that there are

strong multicollinearity or other numerical problems.Our results are virtually the same. We’ll continue with the assumption that our simple linear model is homoskedastic.

Performance Indicators

In predictive modelling, we are interested in the following performance metrics:

Model residuals: recall residuals are the observed value minus the predicted value. We can estimate a model’s Root Mean Squared Error (RMSE) or the Mean Absolute Error (MAE). Residuals allow us to quantify the extent to which the predicted response value (for a given observation) is close to the true response value. Small RMSE or MAE values indicate that the prediction is close to the true observed value.

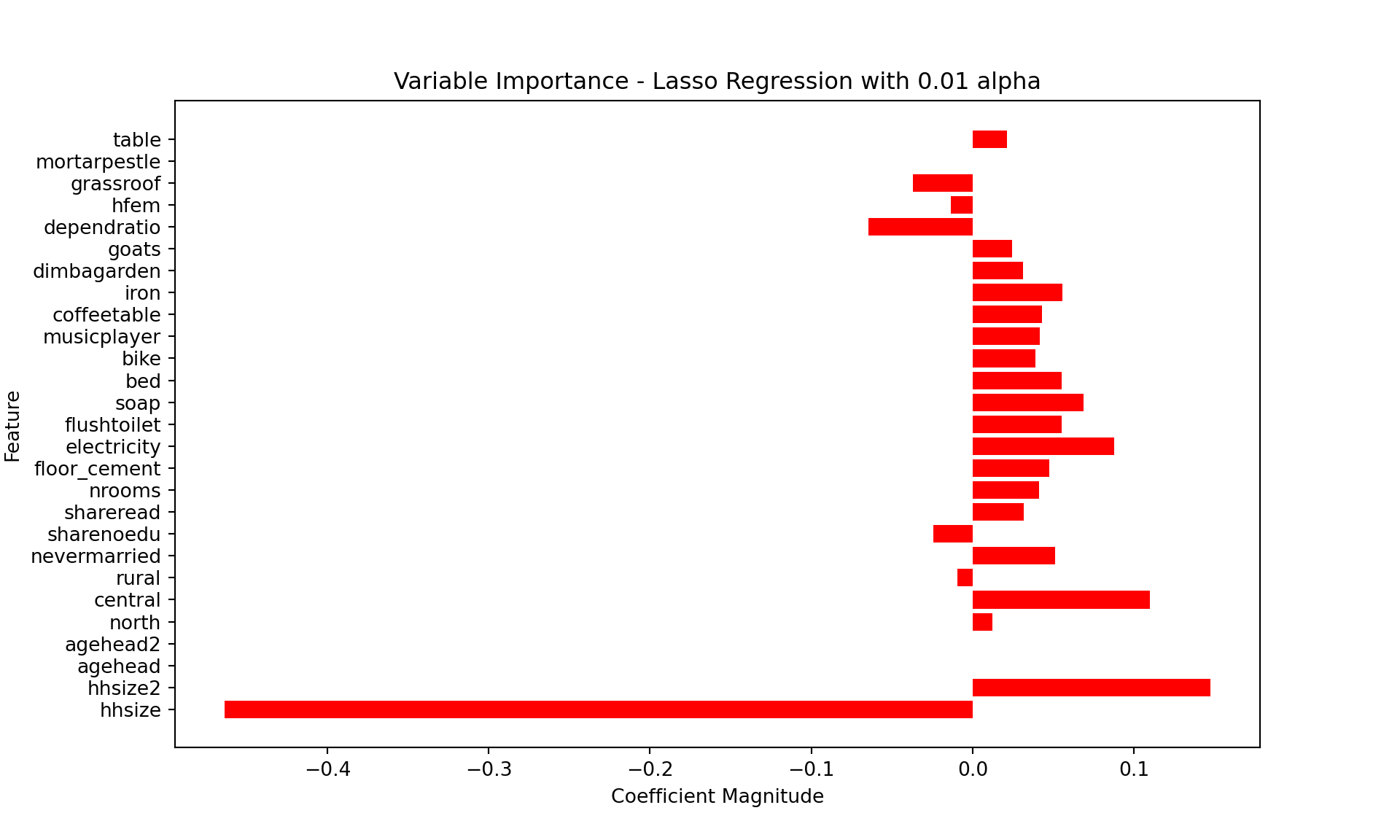

The p-values: represented by stars *** (and a pre-defined critical threshold, e.g. 0.05), they point to the predictive power of each feature in the model; i.e. that the event does not occur by chance. In the same vein, the magnitude of the coefficient is also important, especially given that we are interested in explanatory power and not causality.

The R-squared: arguably the go-to indicator for performance assessment. Low R^2 values are not uncommon, especially in the social sciences. However, when hoping to use a model for predictive purposes, a low R^2 is a bad sign, large number of statistically significant features notwithstanding. The drawback from relying solely on this measure is that it does not take into consideration the problem of model over-fitting; i.e. you can inflate the R-squared by adding as many variables as you want, even if those variables have little predicting power. This method will yield great results in the training data, but will under perform when extrapolating the model to the test (or indeed any other) data set.

Residuals

# = = Model Residuals = = #

print(summary(model1$residuals)) Min. 1st Qu. Median Mean 3rd Qu. Max.

-3.483927 -0.288657 -0.007872 0.000000 0.266950 1.887123 # = = Model Residuals = = #

# residuals of the train dataset

# First, predict values of y based on the fitted linear model

y_pred = model1.predict(X_train)

# Second, calculate residuals. Recall: observed - predicted

residuals_model1 = y_train - y_pred

# Compute summary statistics of residuals

residual_mean = np.mean(residuals_model1)

residual_std = np.std(residuals_model1)

residual_min = np.min(residuals_model1)

residual_25th_percentile = np.percentile(residuals_model1, 25)

residual_median = np.median(residuals_model1)

residual_75th_percentile = np.percentile(residuals_model1, 75)

residual_max = np.max(residuals_model1)

# Print summary statistics

print(f"Mean of residuals: {residual_mean}")Mean of residuals: 4.710573932496453e-16print(f"Standard deviation of residuals: {residual_std}")Standard deviation of residuals: 0.4300319403006682print(f"Minimum residual: {residual_min}")Minimum residual: -3.277590076409238print(f"25th percentile of residuals: {residual_25th_percentile}")25th percentile of residuals: -0.28957325945521095print(f"Median of residuals: {residual_median}")Median of residuals: -0.013638733126897229print(f"75th percentile of residuals: {residual_75th_percentile}")75th percentile of residuals: 0.26574012191749863print(f"Maximum residual: {residual_max}")Maximum residual: 1.8711412012693707Recall that the residual is estimated as the true (observed) value minus the predicted value. Thus: the max(imum) error of 1.88 suggests that the model under-predicted expenditure by circa (log) $2 (or $6.5) for at least one observation. Fifty percent of the predictions (between the first and third quartiles) lie between (log) $0.28 and (log) $0.26 over the true value. From the estimation of the prediction residuals we obtain the popular measure of performance evaluation known as the Root Mean Squared Error (RMSE, for short).

# Calculate the RMSE for the training dataset, or the in-sample RMSE.

# 1. Predict values on the training dataset

p0 <- predict(model1, Train_df)

# 2. Obtain the errors (predicted values minus observed values of target variable)

error0 <- p0 - Train_df[["lnexp_pc_month"]]

# 3. In-sample RMSE

RMSE_insample <- sqrt(mean(error0 ^ 2))

print(RMSE_insample)[1] 0.4271572# TIP: Notice that the in-sample RMSE we have just estimated was also printed in the linear model (regression) output tables!

# The table printed with the stargazer package returns this value at the bottom, under the header Residual Std. Error (0.428)

# The table printed with the modelsummary package returns this value at the bottom, under the header RMSE (0.43), rounded up. # Calculate the RMSE for the training dataset, or the in-sample RMSE.

rmse_insample = mean_squared_error(y_train, y_pred) ** 0.5 # Manually taking the square root

print(rmse_insample)0.43003194030066827The RMSE (0.4271) gives us an absolute number that indicates how much our predicted values deviate from the true (observed) number. This is all in reference to the target vector (a.k.a. our outcome variable). Think of the question, how far, on average, are the residuals away from zero? Generally speaking, the lower the value, the better the model fit. Besides being a good measure of goodness of fit, the RMSE is also useful for comparing the ability of our model to make predictions on different (e.g. test) data sets. The in-sample RMSE should be close or equal to the out-of-sample RMSE.

In this case, our RMSE is ~0.4 units away from zero. Given the range of the target variable (roughly 4 to 11), the number seems to be relatively small and close enough to zero.

P-values

Recall the large number of statistically significant features in our model. The coefficient plot, where we indicate that statistical significance is defined by a p-value threshold of 0.001, a strict rule (given the popularity of the more relaxed 0.05 critical value), shows that only 4 out of 29 features/variables do not meet this criterion. We can conclude that the features we have selected are relevant predictors.

R-squared

print(summary(model1))

Call:

lm(formula = lnexp_pc_month ~ ., data = Train_df)

Residuals:

Min 1Q Median 3Q Max

-3.4839 -0.2887 -0.0079 0.2669 1.8871

Coefficients: (2 not defined because of singularities)

Estimate Std. Error t value Pr(>|t|)

(Intercept) 7.978e+00 4.409e-02 180.945 < 2e-16 ***

hhsize -2.919e-01 6.429e-03 -45.397 < 2e-16 ***

hhsize2 1.206e-02 4.811e-04 25.067 < 2e-16 ***

agehead 2.749e-03 1.712e-03 1.606 0.10835

agehead2 -4.168e-05 1.717e-05 -2.428 0.01519 *

northNorth 8.001e-02 1.439e-02 5.560 2.78e-08 ***

central1 2.521e-01 1.023e-02 24.639 < 2e-16 ***

rural1 -5.483e-02 1.687e-02 -3.250 0.00116 **

nevermarried1 2.706e-01 2.839e-02 9.533 < 2e-16 ***

sharenoedu -1.045e-01 2.006e-02 -5.212 1.91e-07 ***

shareread 7.514e-02 1.502e-02 5.004 5.72e-07 ***

nrooms 3.898e-02 4.032e-03 9.670 < 2e-16 ***

floor_cement1 1.016e-01 1.742e-02 5.835 5.58e-09 ***

electricity1 3.718e-01 2.696e-02 13.793 < 2e-16 ***

flushtoilet1 3.295e-01 3.263e-02 10.099 < 2e-16 ***

soap1 2.150e-01 1.413e-02 15.220 < 2e-16 ***

bed1 1.040e-01 1.297e-02 8.019 1.20e-15 ***

bike1 9.395e-02 1.064e-02 8.831 < 2e-16 ***

musicplayer1 1.111e-01 1.451e-02 7.658 2.08e-14 ***

coffeetable1 1.369e-01 1.866e-02 7.338 2.36e-13 ***

iron1 1.302e-01 1.378e-02 9.455 < 2e-16 ***

dimbagarden1 1.018e-01 1.017e-02 10.017 < 2e-16 ***

goats1 7.964e-02 1.168e-02 6.820 9.68e-12 ***

dependratio -4.501e-02 5.848e-03 -7.697 1.55e-14 ***

hfem1 -6.570e-02 1.238e-02 -5.307 1.14e-07 ***

grassroof1 -9.590e-02 1.575e-02 -6.089 1.18e-09 ***

mortarpestle1 3.288e-02 1.027e-02 3.200 0.00138 **

table1 5.074e-02 1.149e-02 4.417 1.01e-05 ***

clock1 5.840e-02 1.423e-02 4.103 4.11e-05 ***

regionNorth NA NA NA NA

regionSouth NA NA NA NA

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.4278 on 8995 degrees of freedom

Multiple R-squared: 0.5986, Adjusted R-squared: 0.5973

F-statistic: 479 on 28 and 8995 DF, p-value: < 2.2e-16We have printed our model’s output once more, now using the r base command summary(). The other packages (stargazer and modelsummary) are great if you want to export your results in text, html, latex format, but not necessary if you just want to print your output.

from sklearn.metrics import r2_score # an evaluation metric (r-squared) that we didn't load at the beginning

r2_train = r2_score(y_train, model1.predict(X_train))

# Print the R-squared on the training set

print(f"R-squared on the training dataset: {r2_train}")R-squared on the training dataset: 0.5992973775467875The estimated (Multiple) R-squared of 0.59 tells us that our model predicts around 60 per cent of the variation in the independent variable (our target, log of per capita monthly expenditures). Also note that when we have a large number of predictors, it’s best to look at the Adjusted R-squared (of 0.59), which corrects or adjusts for this by only increasing when a new feature improves the model more so than what would be expected by chance.

Out of sample predictions

Now that we have built and evaluated our model in the training dataset, we can proceed to make out-of-sample predictions. That is, see how our model performs in the test dataset.

p <- predict(model1, Test_df)

### Observed summary statistics of target variable in full dataset

print(summary(data_malawi$lnexp_pc_month)) Min. 1st Qu. Median Mean 3rd Qu. Max.

4.777 6.893 7.305 7.359 7.758 11.064 ### Predictions based on the training dataset

print(summary(p0)) Min. 1st Qu. Median Mean 3rd Qu. Max.

6.011 6.980 7.308 7.357 7.661 10.143 ### Predictions from the testing dataset

print(summary(p)) Min. 1st Qu. Median Mean 3rd Qu. Max.

6.052 6.999 7.323 7.375 7.670 9.774 # predict y(target) values based on the test data model, with model trained on

y_test_pred = model1.predict(X_test)

# Calculate Root Mean Squared Error on the test set

rmse_test = mean_squared_error(y_test, y_test_pred) ** 0.5 # Manually taking the square root

# Estimate the R squared of the test model

r2_test = r2_score(y_test, model1.predict(X_test))

# Print the Mean Squared Error and R-squared on the test set

print(f"Root Mean Squared Error on the test set: {rmse_test}")Root Mean Squared Error on the test set: 0.4194659226478787print(f"R-squared on the test dataset: {r2_test}")R-squared on the test dataset: 0.5947626941805588The summary statistics for the predictions with the train and test datasets are very close to one another. This is an indication that our model extrapolates well to other datasets. Compared to the observed summary statistics of the target variable, they’re relatively close, with the largest deviations observed at the minimum and maximum values.

The bias-variance tradeoff in practice

We previously mentioned that the RMSE metric could also be used to compare between train and test model predictions. Let us estimate the out-of-sample RMSE:

error <- p - Test_df[["lnexp_pc_month"]] # predicted values minus actual values

RMSE_test <- sqrt(mean(error^2))

print(RMSE_test) # this is known as the out-of-sample RMSE[1] 0.4284404Notice that the in-sample RMSE [\(0.4271572\)] is very close to the out-of-sample RMSE [\(0.4284404\)]. This means that our model makes consistent predictions across different data sets. We also know by now that these predictions are relatively good. At least, we hit the mark around 60 per cent of the time. What we are observing here is a model that has found a balance between bias and variance. However, both measures can still improve. For one, McBride and Nichols (2018) report > 80 per cent accuracy in their poverty predictions for Malawi. But please note that, at this point, we are not replicating their approach. They document using a classification model, which means that they previously used a poverty line score and divided the sample between individuals below and above the poverty line.

What do we mean by bias in a model?

The bias is the difference between the average prediction of our model and the true (observed) value. Minimising the bias is analogous to minimising the RMSE.

What do we mean by variance in a model?

It is the observed variability of our model prediction for a given data point (how much the model can adjust given the data set). A model with high variance would yield low error values in the training data but high errors in the test data.

Hence, consistent in and out of sample RMSE scores = bias/variance balance.

Fine-tuning model parameters

Can we fine-tune model parameters? The quick answer is yes! Every algorithm has a set of parameters that can be adjusted/fine-tuned to improve our estimations. Even in the case of a simple linear model, we can try our hand at fine-tuning with, for example, cross-validation.

What is cross-validation?

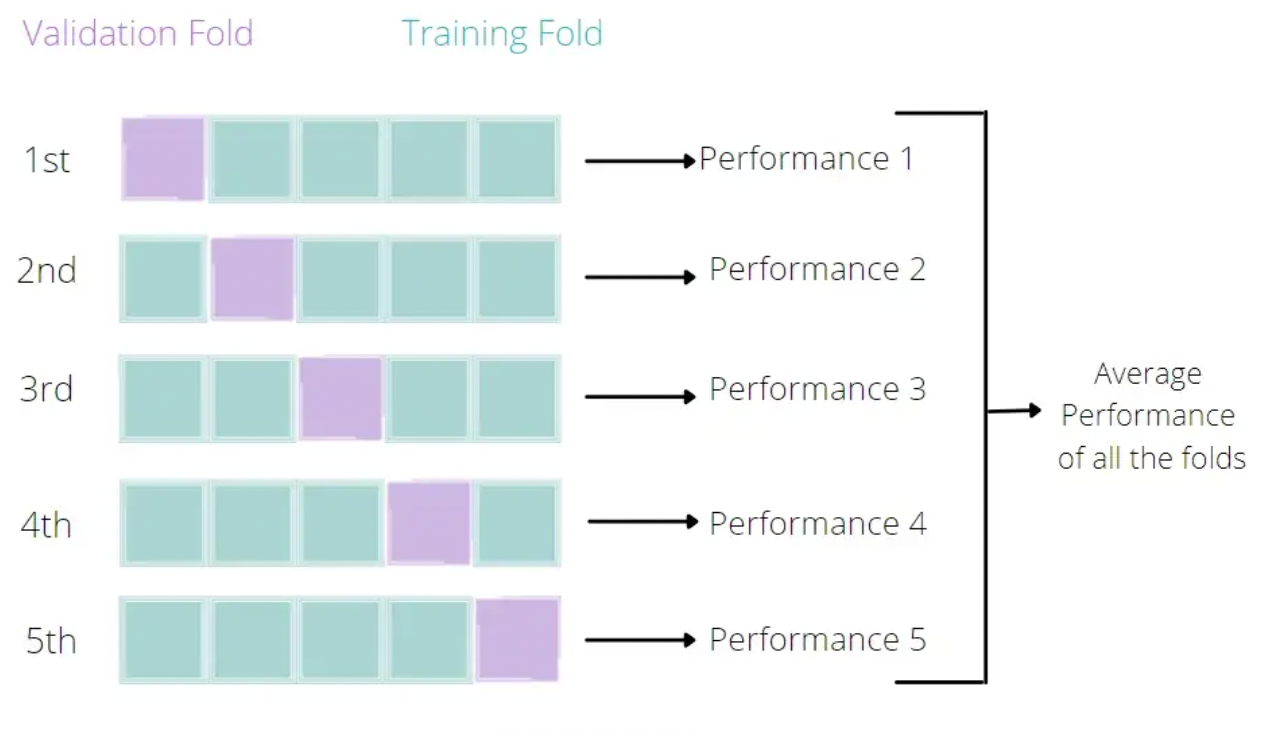

Broadly speaking, it is a technique that allows us to assess the performance of our machine learning model. How so? Well, it looks at the ‘stability’ of the model. It’s a measure of how well our model would work on new, unseen data (is this ringing a bell yet?); i.e. it has correctly observed and recorded the patterns in the data and has not captured too much noise (what we know as the error term, or what we are unable to explain with our model). K-fold cross-validation is a good place to start for such a thing. In the words of The Internet™, what k-fold cross validation does is:

Split the input dataset into K groups

For each group:

- Take one group as the reserve or test data set.

- Use remaining groups as the training dataset.

- Fit the model on the training set and evaluate the performance of the model using the test set.TL;DR We’re improving our splitting technique!

An Illustration by Eugenia Anello

# Let's rumble!

set.seed(12345)

# create an object that defines the training method as cross-validation and number of folds (caret pkg)

cv_10fold <- trainControl(

method = "cv", #cross-validation

number = 10 # k-fold = 10-fold (split the data into 10 similar-sized samples)

)

set.seed(12345)

# train a model

ols_kfold <- train(

lnexp_pc_month ~ .,

data = Train_df,

method = 'lm', # runs a linear regression model (or ols)

trControl = cv_10fold # use 10 folds to cross-validate

)

ols_kfold2 <- train(

lnexp_pc_month ~ .,

data = Test_df,

method = 'lm', # runs a linear regression model (or ols)

trControl = cv_10fold # use 10 folds to cross-validate

)

ols_kfold3 <- train(

lnexp_pc_month ~ .,

data = data_malawi,

method = 'lm', # runs a linear regression model (or ols)

trControl = cv_10fold # use 10 folds to cross-validate

)

### Linear model with train dataset

print(ols_kfold)Linear Regression

9024 samples

29 predictor

No pre-processing

Resampling: Cross-Validated (10 fold)

Summary of sample sizes: 8121, 8121, 8123, 8122, 8121, 8121, ...

Resampling results:

RMSE Rsquared MAE

0.4295064 0.5947776 0.3365398

Tuning parameter 'intercept' was held constant at a value of TRUE#### Linear model with test dataset

print(ols_kfold2)Linear Regression

2256 samples

29 predictor

No pre-processing

Resampling: Cross-Validated (10 fold)

Summary of sample sizes: 2030, 2030, 2030, 2030, 2031, 2031, ...

Resampling results:

RMSE Rsquared MAE

0.4312944 0.5991526 0.3379473

Tuning parameter 'intercept' was held constant at a value of TRUE### Linear model with full dataset")

print(ols_kfold3)Linear Regression

11280 samples

29 predictor

No pre-processing

Resampling: Cross-Validated (10 fold)

Summary of sample sizes: 10152, 10152, 10152, 10152, 10152, 10152, ...

Resampling results:

RMSE Rsquared MAE

0.4291473 0.5965825 0.3363802

Tuning parameter 'intercept' was held constant at a value of TRUEHaving cross-validated our model with 10 folds, we can see that the results are virtually the same. We have a RMSE of around .43, an R^2 of .59, (and a MAE of .33). We ran the same model for the train, test and full datasets and find results are consistent. Recall the R^2 tells us the model’s predictive ability and the RMSE and MAE the model’s accuracy.

from sklearn.model_selection import cross_val_score, KFold

# Linear regression model with k-fold cross-validation

# This time around, we'll work with a) the full dataset (no need to split beforehand) and b) model objects instead of estimating the

# model on-the-fly!

# object that contains an empty linear regression model

model_kcrossval = LinearRegression()

# object that contains the number of folds (or partitions) that we want to have

k_folds = 10 # 5 or 10 are standard numbers. Choosing the optimal number of folds is beyond the score of this tutorial.

# object that contains a k-fold cross-validation

model_kf = KFold(n_splits=k_folds, shuffle=True, random_state=12345) #recall we had used 12345 as our random state before as well...

# estimate a k-fold cross-validated model!

kfold_mse_scores = -cross_val_score(model_kcrossval, X, y.ravel(), cv=model_kf, scoring='neg_mean_squared_error')<string>:3: FutureWarning: Series.ravel is deprecated. The underlying array is already 1D, so ravel is not necessary. Use `to_numpy()` for conversion to a numpy array instead.What is happening in the line of code that estimates the k-fold cross-validated model? Let’s see if we can make sense of it: + The -cross_val_score (yes, with a minus sign) is a function that is used to estimate cross-validation models. + Inside the function, we specify the type of model (model_kcrossval = LinearRegression) + Inside the function, we specify which dataframe (matrix of features X, full dataset minus the target vriable) + Inside the function, we specify which target variable y (full dataset), the y.ravel() is to ensure that the function reads it as a one-dimensional array + Inside the function, we specify what type of cross-validation (cv) technique. Our model_kf object defines the cv technique as a k-fold cross-validation with 10 folds. + Inside the function, we select a ‘scoring’ = negative mean squared error. Why negate the mse? it’s to explicitly tell scikit-learn (the library we are using) to minimise the mean squared errors, it’s default is to maximise them.

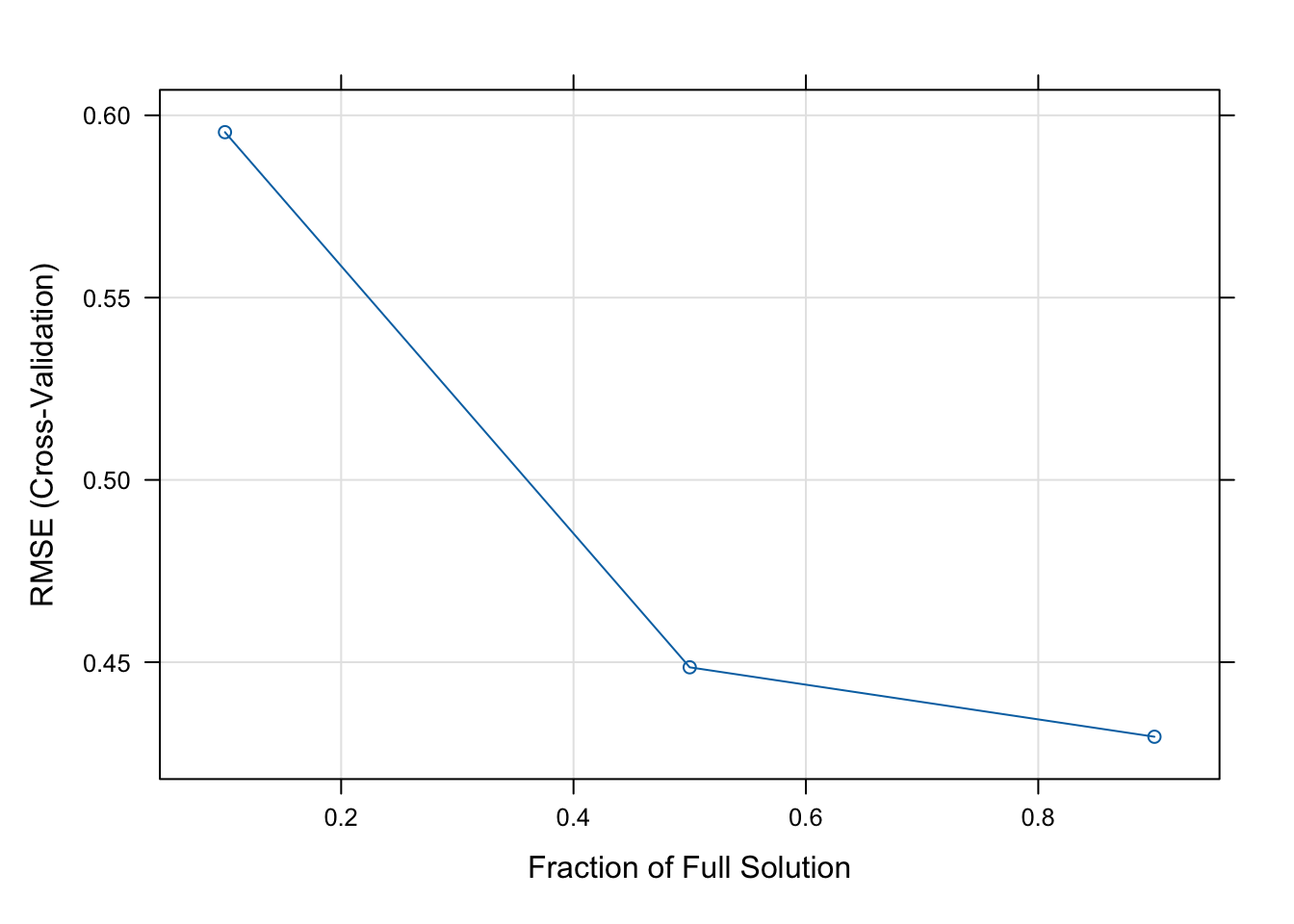

The output that we get is the estimated mean squared error per fold, but we can also get the average of all folds and the root mean squared error that we’ve been using thus far.

# get the average mse from all 10 folds

average_kfold_mse = np.mean(kfold_mse_scores) # finally, numpy library in action

print("Mean Squared Error for each fold:", kfold_mse_scores)Mean Squared Error for each fold: [0.1721741 0.17878181 0.19410003 0.17626526 0.19455392 0.18466671

0.16980631 0.20032969 0.17379885 0.20905726]print(f"Average Mean Squared Error: {average_kfold_mse}")Average Mean Squared Error: 0.18535339333850842# get the RMSE, so that we can compare the performance of our cross-validated model

kfold_rmse_scores = np.sqrt(kfold_mse_scores)

average_kfold_rmse = np.sqrt(average_kfold_mse)

print("Root Mean Squared Error for each fold:", kfold_rmse_scores)Root Mean Squared Error for each fold: [0.41493867 0.42282598 0.44056784 0.41983957 0.44108267 0.42972865